Exness Deposit and Withdraw Money in India

How to Deposit Money in Exness India

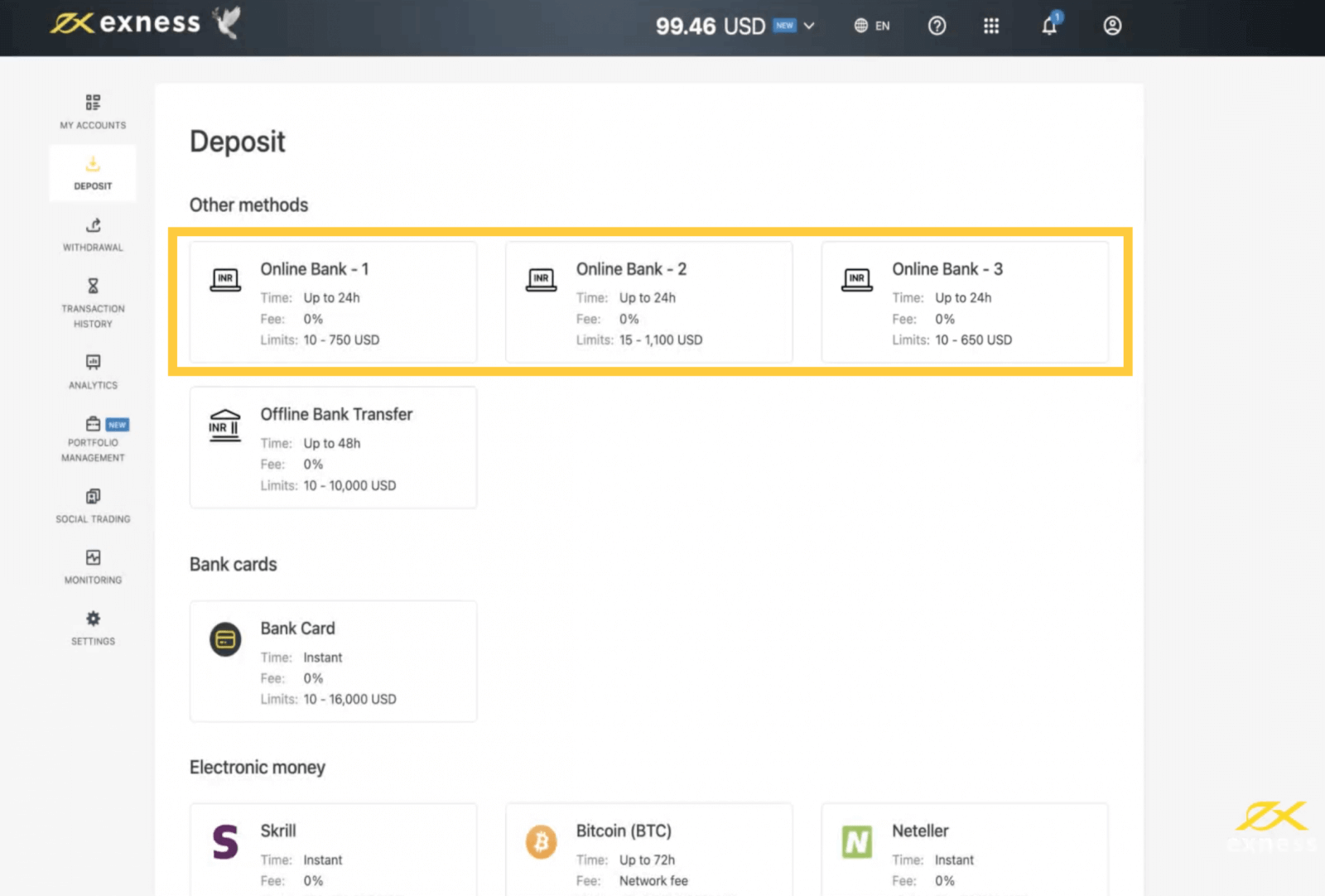

Deposit into Exness India via Bank Transfer

Transactions with your Exness trading accounts in India are made simple with online bank transfers and charge no commission for deposits or withdrawals.Please note your options for the deposit method will depend on which bank you transact with. All conditions that apply to the deposit method are listed below. Please visit your Personal Area to be shown your available deposit options.

Here’s what you need to know about using online bank transfers:

| India | |||

| Online Bank Transfer #1 | Online Bank Transfer #2 | Online Bank Transfer #3 |

|

| Minimum Deposit | USD 10 | USD 15 | USD 10 |

| Maximum Deposit | USD 750 | USD 1 100 | USD 650 |

| Minimum Withdrawal |

USD 15 USD 1 250 |

||

| Maximum Withdrawal | |||

| Deposit and Withdrawal Processing Fees | Free | ||

| Deposit Processing Time | 24 hours | 24 hours | 24 hours |

| Withdrawal Processing Time | Up to 72 hours | ||

Note: The limits specified above are per transaction unless mentioned otherwise.

1. Choose from these options (if available) in the Deposit area of your Personal Area:

- Online Bank Transfer #1

- Online Bank Transfer #2

- Online Bank Transfer #3

Note: on-screen instructions may vary depending on the method chosen.

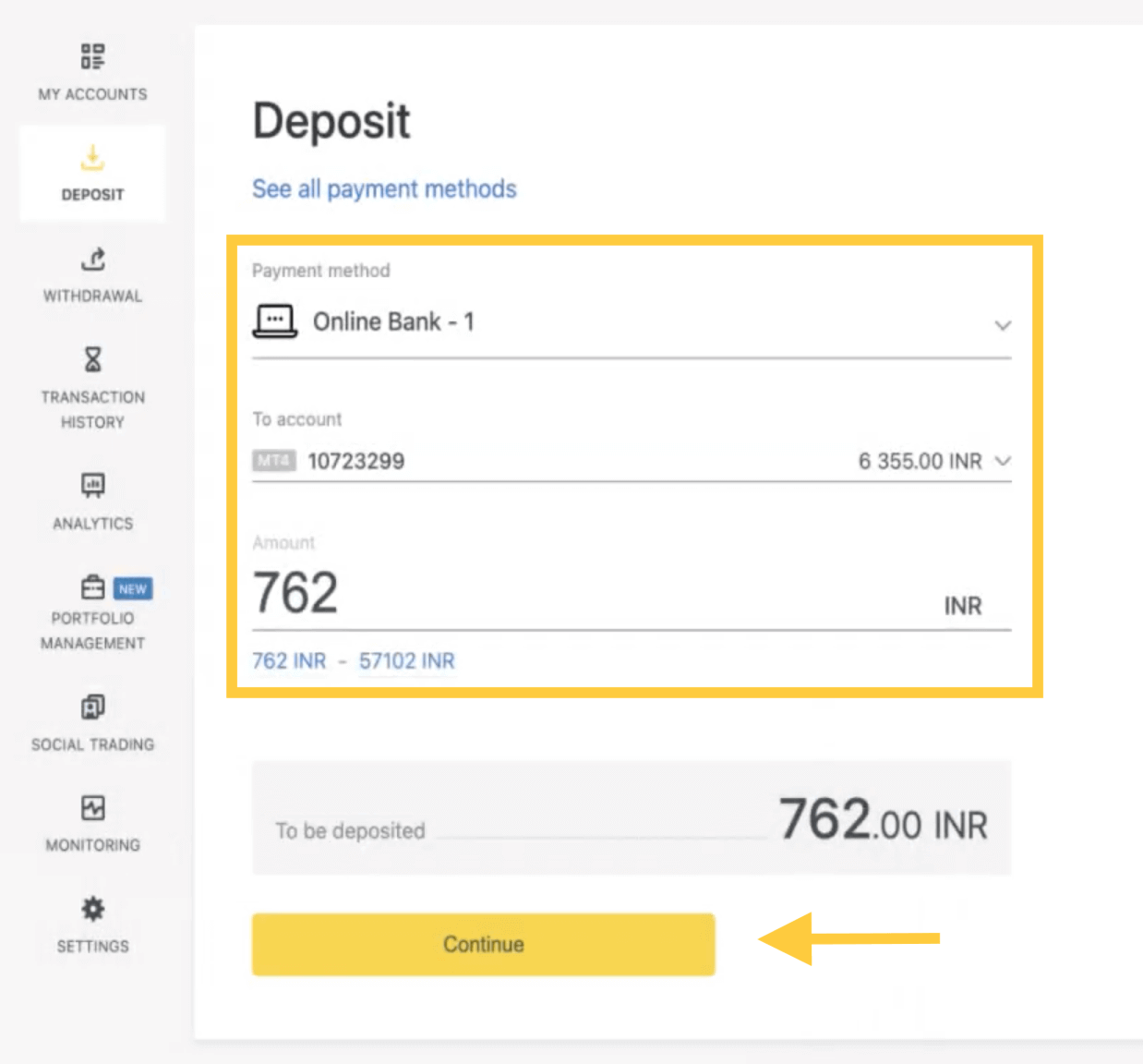

2. Select the trading account you would like to top up, as well as the deposit amount, then click Continue.

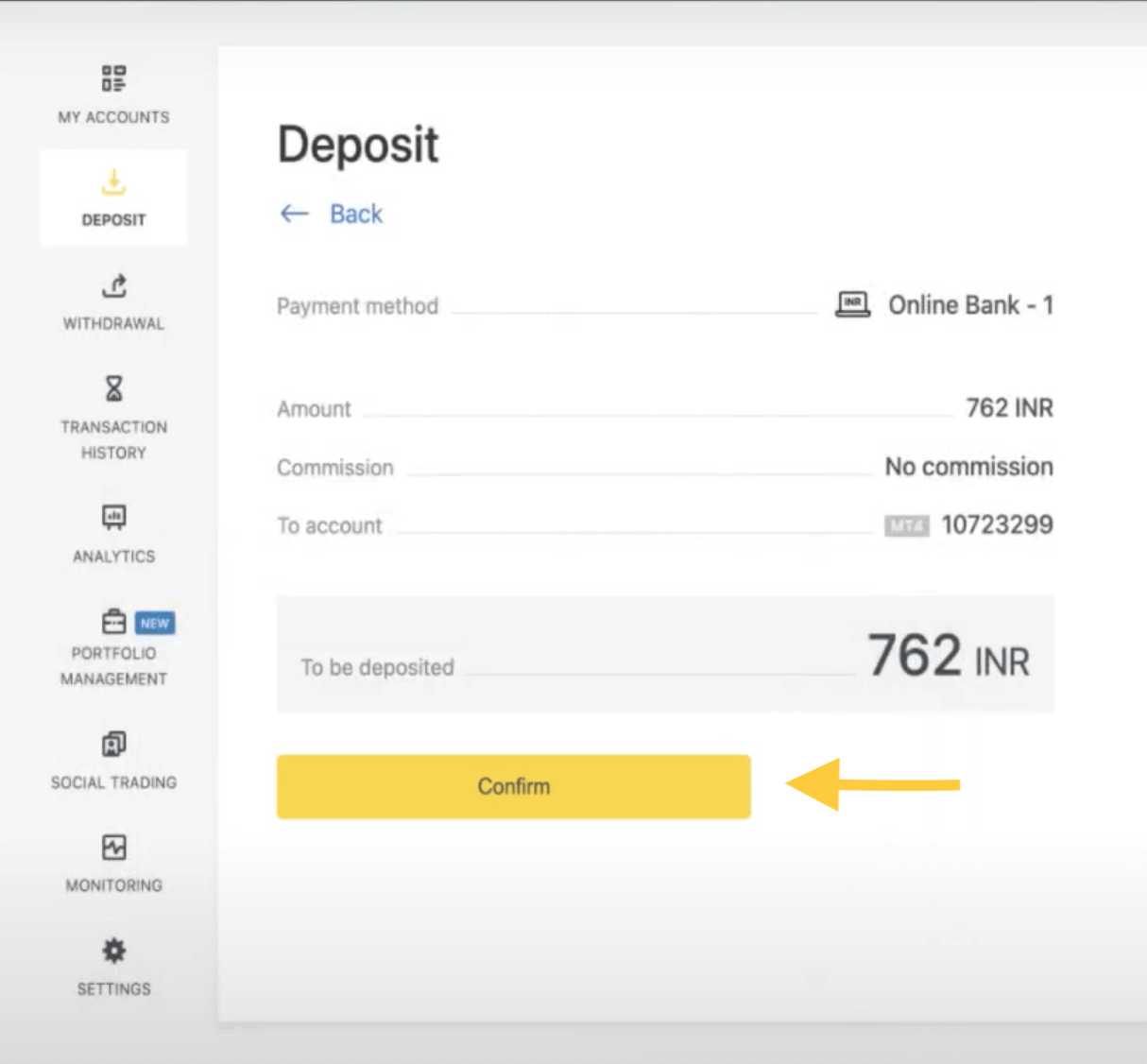

3. A summary of the transaction will be presented to you; click Confirm to continue.

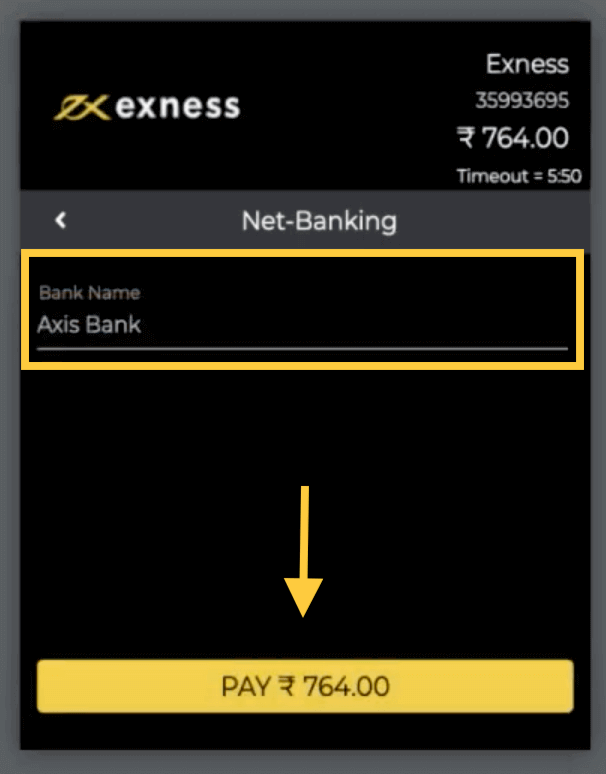

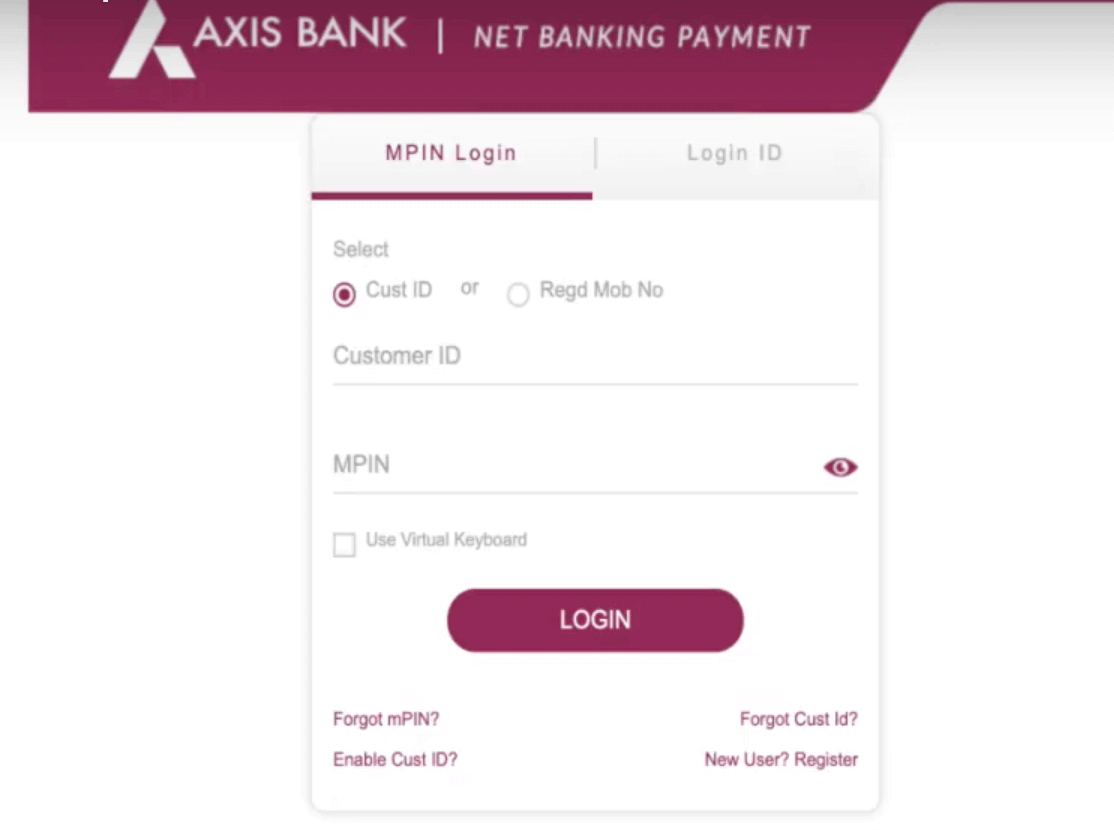

4. You are redirected to a new page to select your bank. Confirm your choice by clicking Pay.

5. Continue to follow the on-screen instructions to complete your deposit.

Deposit into Exness India via UPI QR

Transactions in India are easier than ever with the QR-based method of payment - UPI QR, now available for your use. Both deposits and withdrawals are free of charge when transacting with your Exness account, and an easy to follow guide is presented below for your convenience.Here’s what you need to know about using UPI QR payments in India:

|

India |

|

| Minimum Deposit | USD 13 |

| Maximum Deposit | USD 2 500 per day |

| Minimum Withdrawal | USD 15 |

| Maximum Withdrawal | USD 1 250 |

| Deposit and withdrawal Fees | Free |

| Deposit Processing Time | Instant |

| Withdrawal Processing Time | Up to 24 hours |

Note:

- Your Exness account must be fully verified in order for you to use this payment system.

- The limits specified above are per transaction unless mentioned otherwise.

1. Go to the Deposit tab in your Personal Area (PA) and select UPI QR.

2. Select the trading account for deposit, as well as the desired amount, then click Continue.

3. Now a transaction summary is presented, and you can click Confirm payment to continue.

4. The redirected page will display a QR code. Click on the download icon to download the displayed QR code.

5. Open the UPI application on your phone and locate the QR code scanner, Browse and select the downloaded QR code.

- Alternatively, you can also scan the QR code displayed.

6. The payment instructions will appear on the screen. Click Validate payment to confirm the deposit transaction.

Deposit into Exness India via UPI

Unified Payments Interface (UPI) is an inter-bank payment system available in India that can be used to fund your Exness trading accounts. There’s no commission on transactions with this payment method, but a fully verified account is required to use it.

Here’s what you need to know about using UPI:

| India | |

|---|---|

| Minimum Deposit | USD 10 |

| Maximum Deposit | USD 620 |

| Minimum Withdrawal | USD 10 |

| Maximum Withdrawal | USD 620 |

| Deposit and Withdrawal Processing Fees | Free |

| Deposit Processing Time | 24 hours |

| Withdrawal Processing Time | 72 hours |

Note: The limits specified above are per transaction unless mentioned otherwise.

1. Select UPI from the Deposit area of your Personal Area.

2. Select the trading account you would like to top up, as well as the deposit amount, then click Next.

3. A transaction summary is presented; click Confirm to continue.

4. On the redirected page, enter your UPI ID and fill in all the fields on the form presented. Click Pay.

5. A payment instruction will be displayed requiring some action to be taken on the UPI mobile application. Confirm the action with your mobile app to complete the deposit transaction.

How to Withdraw Money from Exness India

Withdraw from Exness India via Bank Transfer

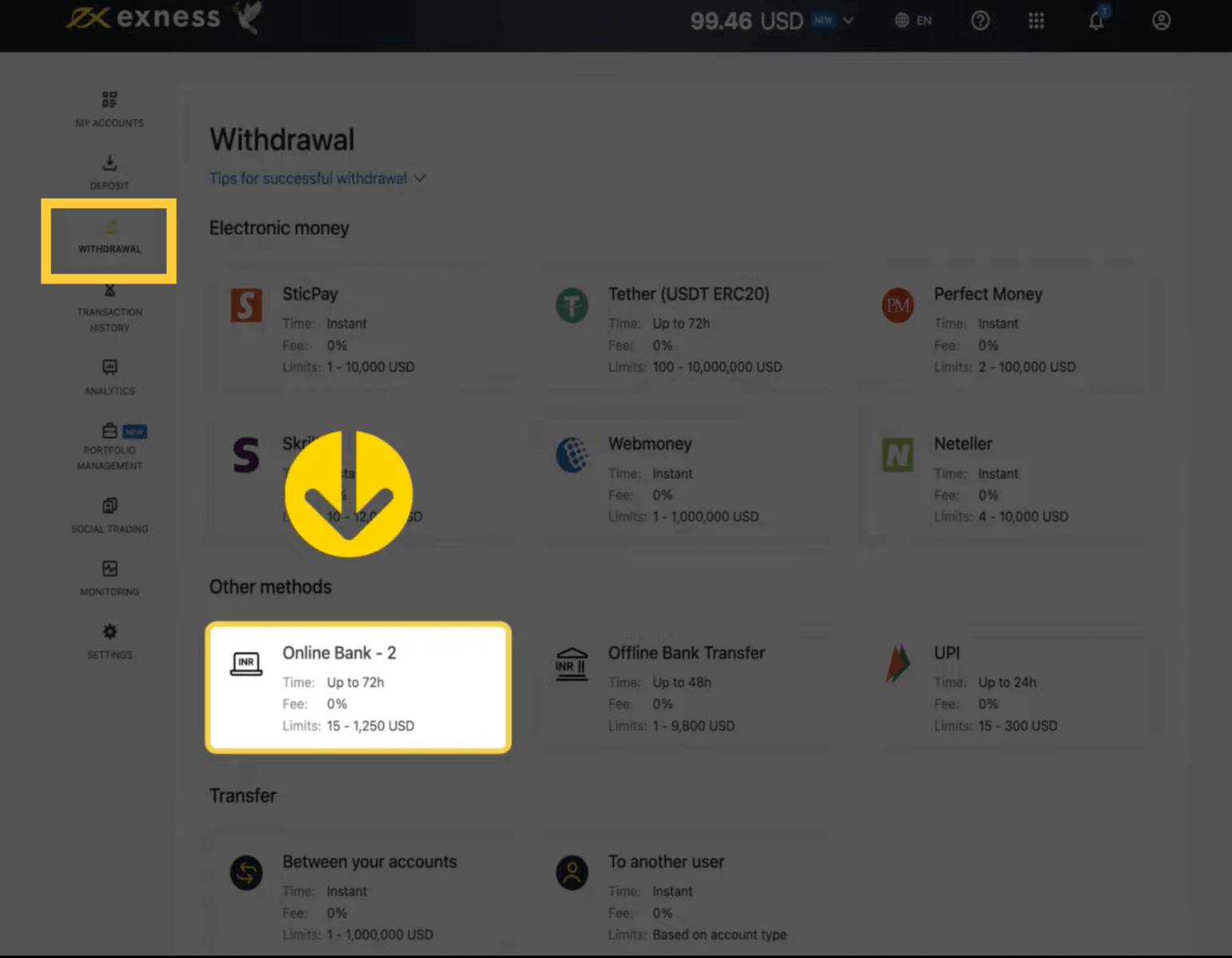

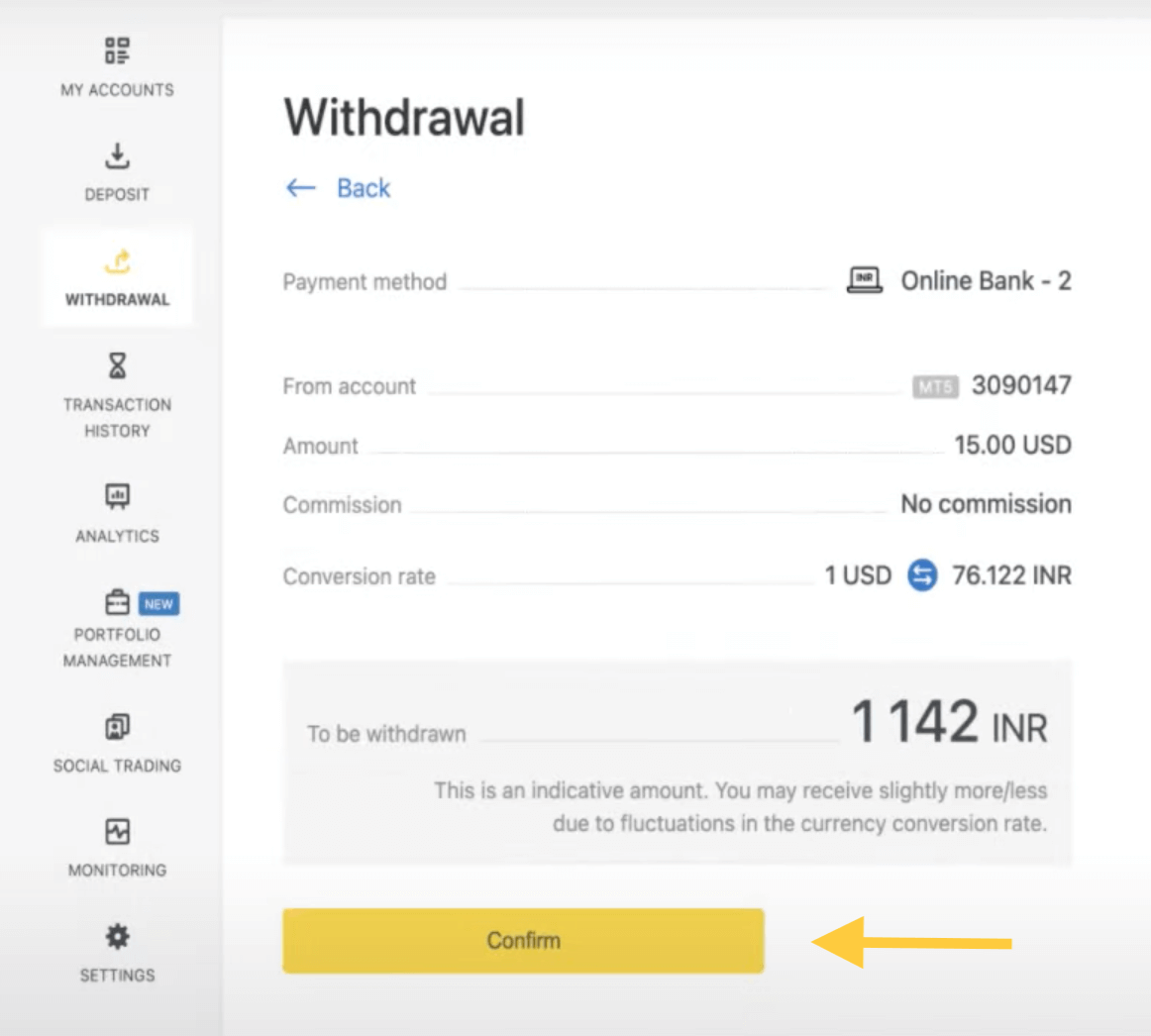

1. Select Online bank transfer from the Withdrawal section of your Personal Area.

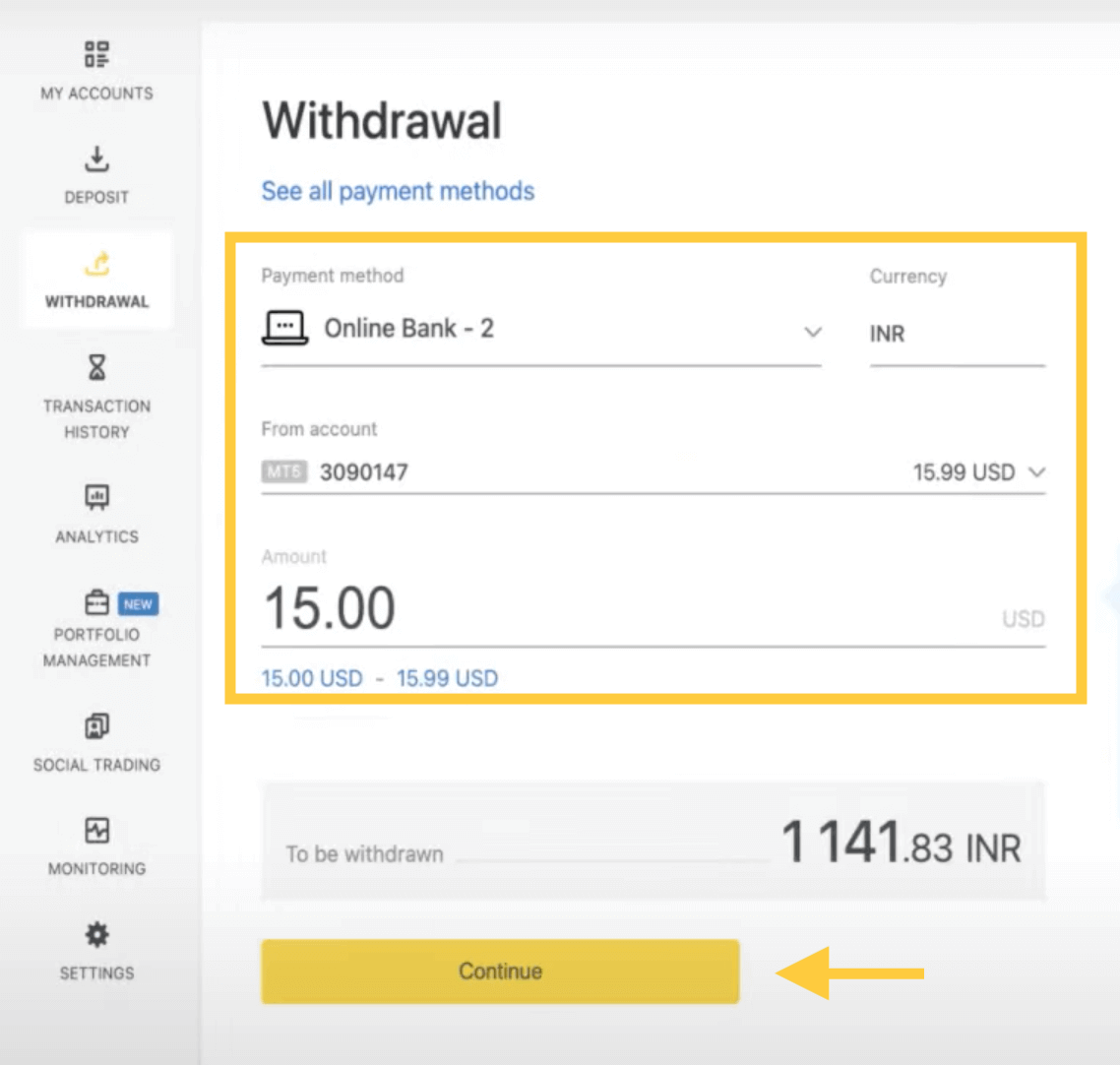

2. Choose the trading account you want to withdraw from and enter the withdrawal amount in the shown currency. Click Continue.

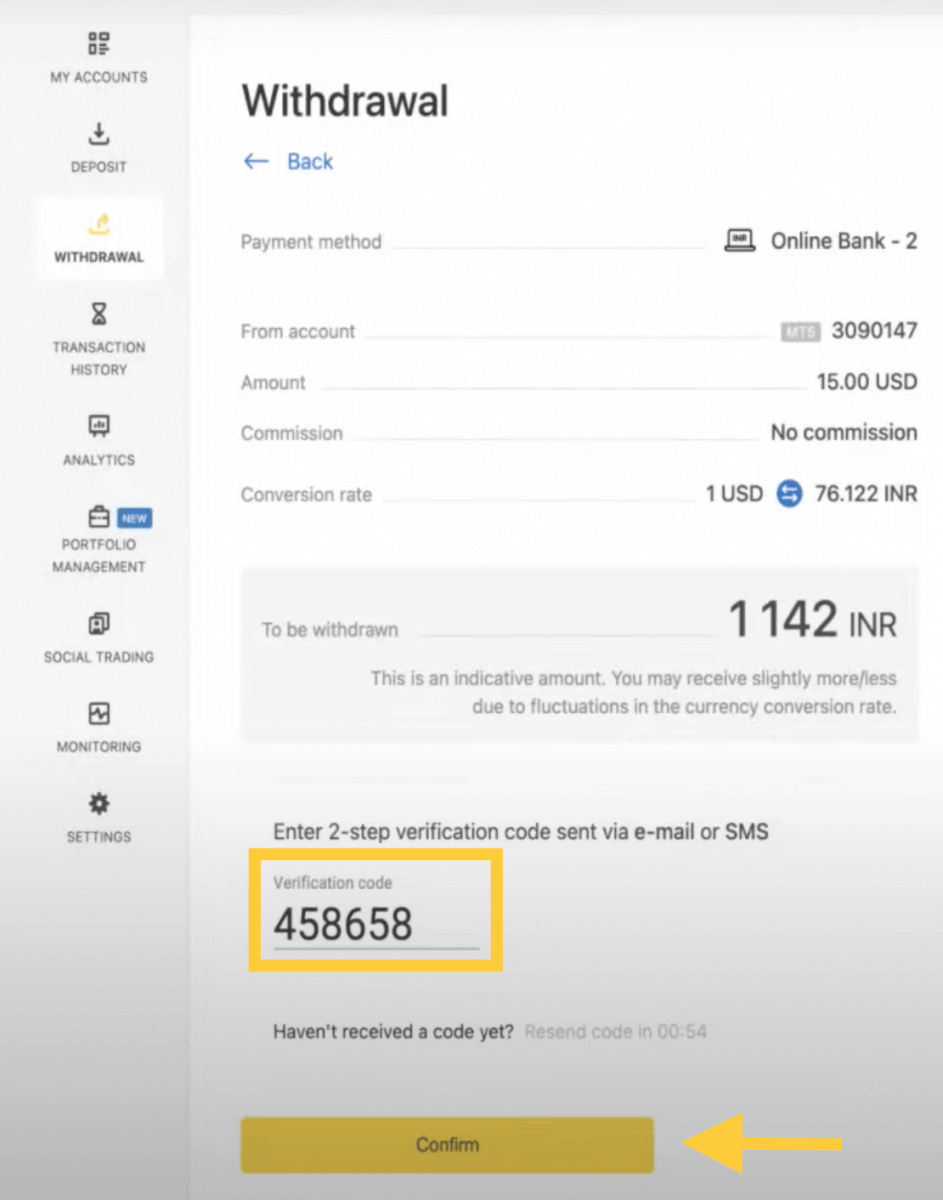

3. You will now see a summary of the transaction. Enter the verification code sent to your phone or email, based on your chosen security type, then confirm the action.

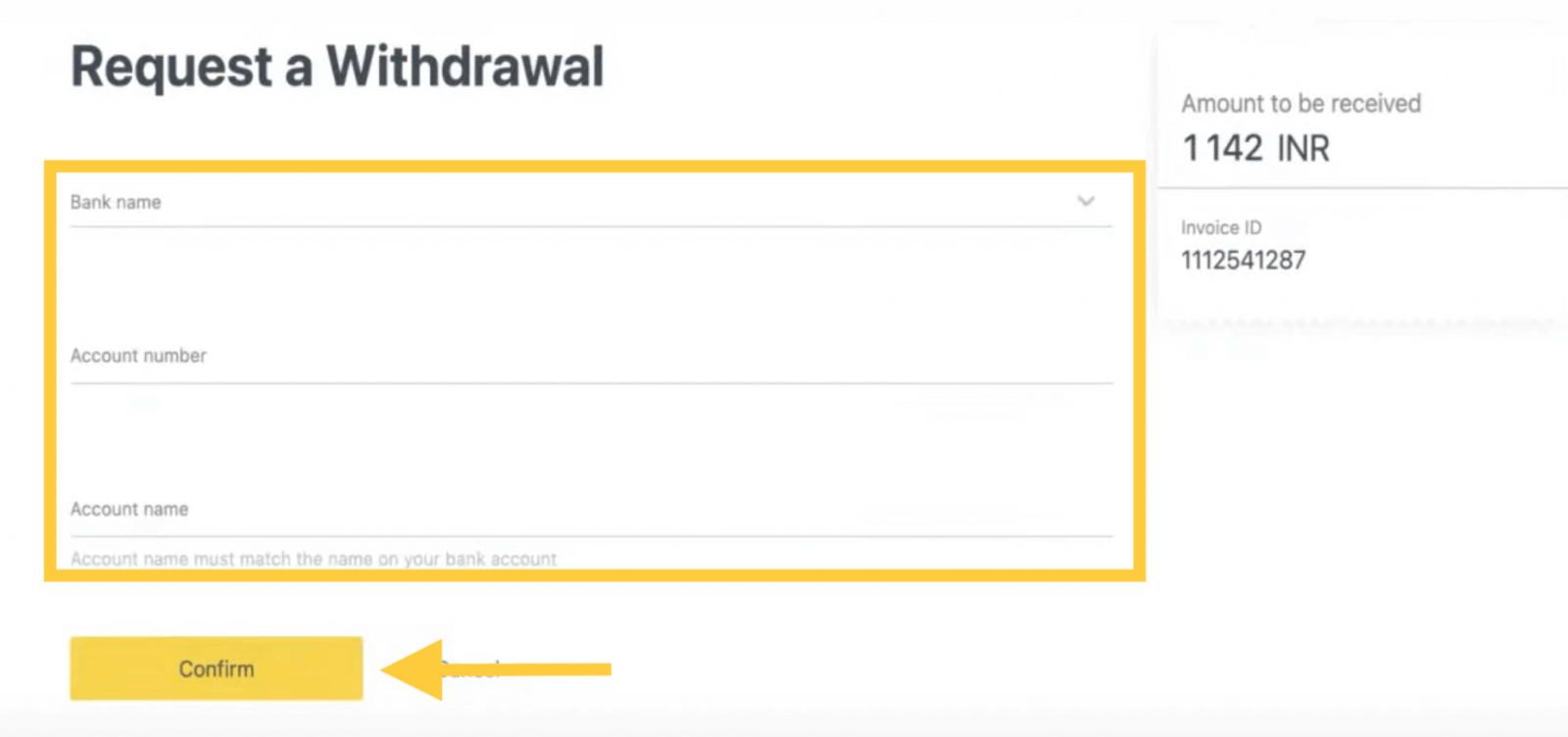

4. You will now be redirected to a page where you will need to enter the following information:

b. Your Indian Financial System Code (IFSC)

c. Bank account number

d. Bank account name

In case information is entered incorrectly, an error message will appear.

Click Confirm. Your transaction is now complete.

Withdraw from Exness India via UPI

1. Select UPI from the Withdrawal area of your Personal Area.2. Select the trading account and the amount to be withdrawn, then click Continue.

3. A summary of the transaction will be shown. Enter the verification code sent to you either by email or SMS depending on your Personal Area security type. Click Confirm.

4. You will now be redirected to a page where you will need to enter the following information:

b. Account holder’s name (matching UPI account and Exness account holder)

5. Click Confirm. Your transaction is now complete.