Exness Deposit and Withdraw Money in Africa

How to Deposit Money in Exness Africa

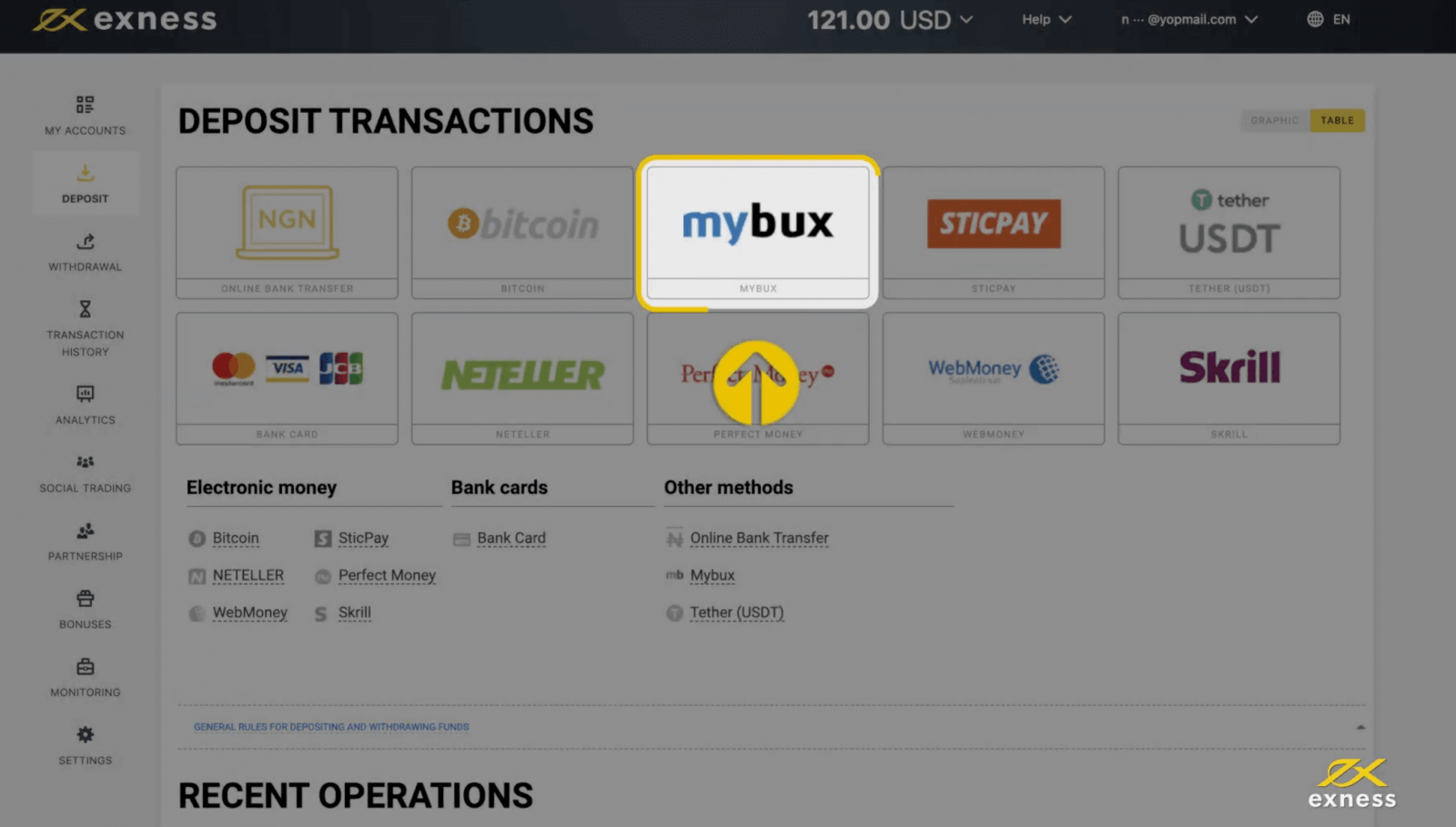

Deposit into Exness Africa via MyBux

It’s easier than ever to fund your Exness account with MyBux, an electronic payment platform available for transactions in select regions across Africa. There’s no commission when depositing into your Exness account with this payment option, while withdrawals are free of charge too.MyBux transactions with Exness are available to residents of the following African countries:

- Nigeria

- Ghana

- South Africa

- Kenya

- Uganda

- Zambia

- Rwanda

- Cameroon

- Senegal

- Kenya

- Uganda

- Zambia

- Rwanda

Here’s what you need to know about using MyBux in Africa:

|

Africa |

|

|

Minimum Deposit |

Refer to the table below for maximum and minimum deposit and withdrawal rates for various African regions. |

|

Maximum Deposit |

|

|

Minimum Withdrawal |

|

|

Maximum Withdrawal |

|

|

Deposit and Withdrawal Processing Fees |

A fee may be applicable depending on your mobile operator |

|

Deposit and Withdrawal Processing Time |

Instant* |

Regional Transaction Limits:*The term “instant” indicates that a transaction will be carried out within a few seconds without manual processing by our financial department specialists.

Each region serviced by MyBux presents maximum and minimum transaction amounts based on the region:

| Country | Transaction | Minimum | Maximum |

| Nigeria | Deposit | USD 10 | USD 850 |

| Withdrawal | USD 2 | USD 900 | |

| Ghana | Deposit | USD 10 | USD 260 |

| Withdrawal | USD 2 | USD 300 | |

| Kenya | Deposit | USD 10 | USD 560 |

| Withdrawal | USD 2 | USD 565 | |

| Uganda | Deposit | USD 10 | USD 850 |

| Withdrawal | USD 2 | USD 1 000 | |

| Zambia | Deposit | USD 10 | USD 265 |

| Withdrawal | USD 2 | USD 270 | |

| Rwanda | Deposit | USD 10 | USD 850 |

| Withdrawal | USD 2 | USD 2 000 | |

| South Africa | Deposit | USD 10 | USD 550 |

| Withdrawal | USD 5 | USD 550 | |

| Senegal | Deposit | USD 10 | USD 850 |

| Withdrawal | USD 6 | USD 850 | |

| Cameroon | Deposit | USD 10 | USD 850 |

| Withdrawal | USD 5 | USD 850 | |

| Namibia | Deposit | USD 10 | USD 860 |

| Withdrawal | N/A | N/A |

*Withdrawal limits are determined by the payment system available to these countries.

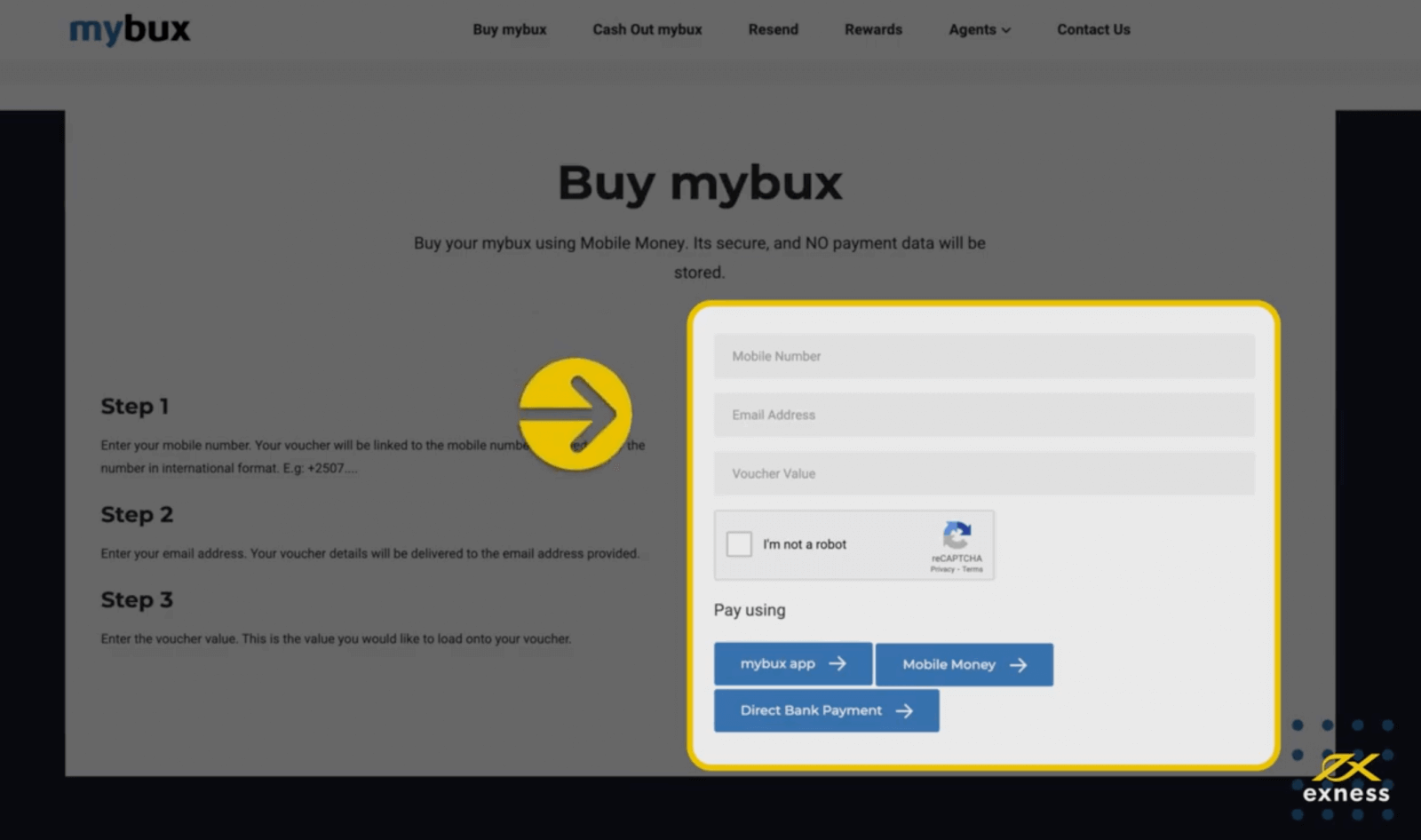

Before you begin please note the steps to purchase a MyBux voucher, needed for depositing funds into your trading account.

To purchase a MyBux voucher:

2. You will be asked to provide your phone number, which becomes linked to the voucher.

3. Provide your email address; the MyBux voucher number and other details will be sent here, so copy this voucher number for later.

4. Enter a value for your MyBux voucher, then select your payment method - MyBux currently presents Mobile Money or direct bank payment as options.

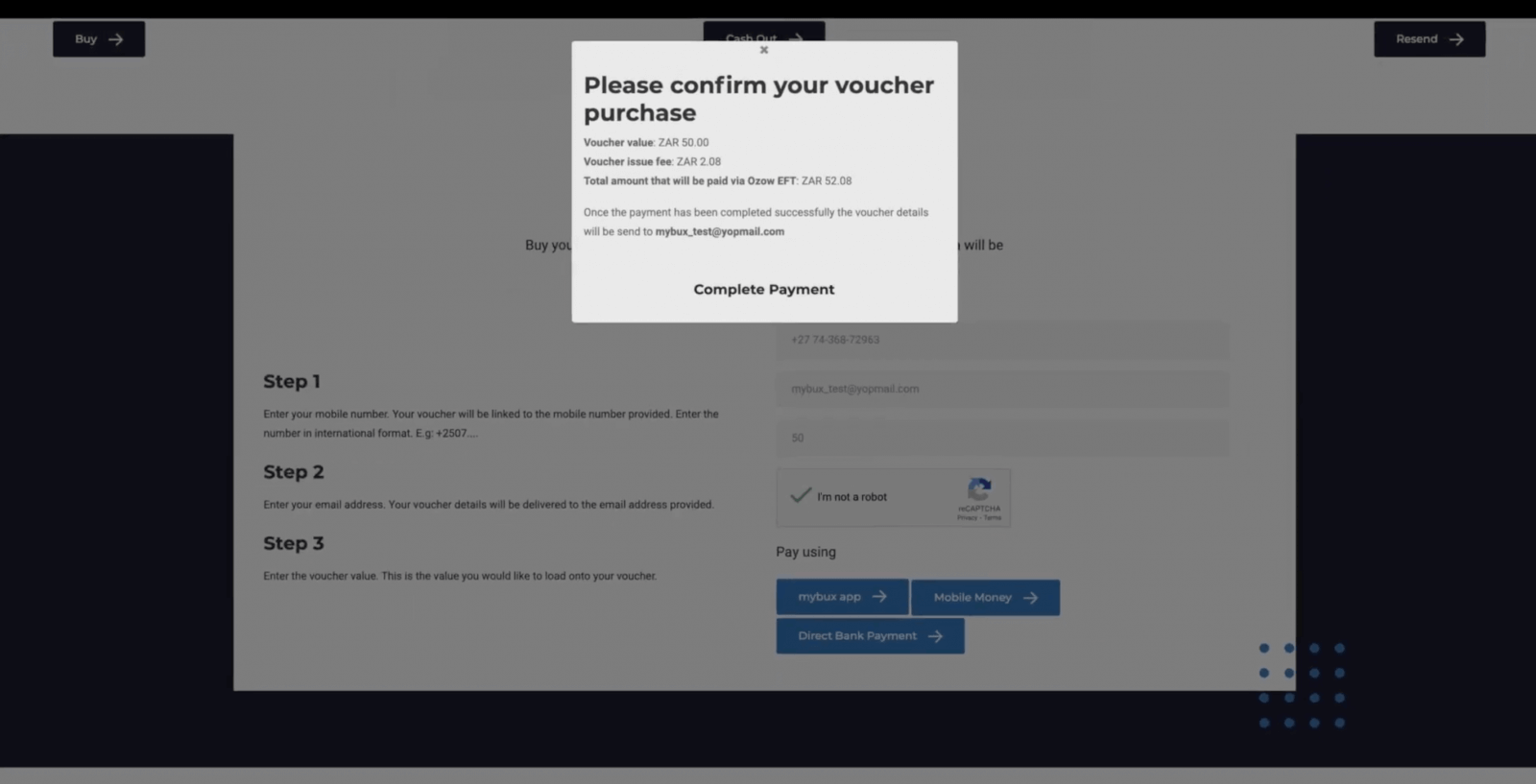

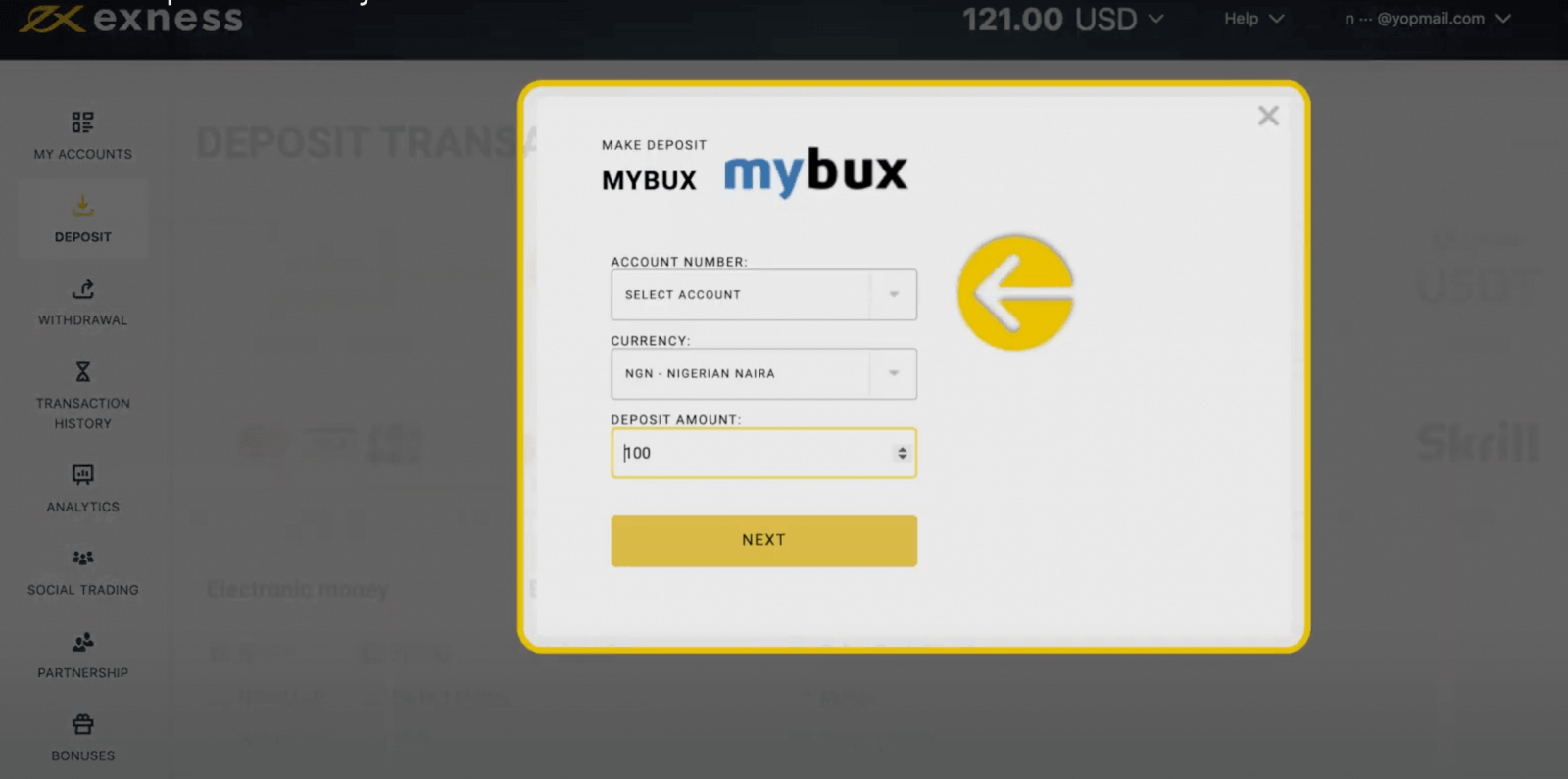

To deposit into your trading account with a MyBux voucher:

2. Select the trading account you would like to top up, the currency, as well as the deposit amount (note that the deposit amount must match the value of the voucher exactly), then click Next.

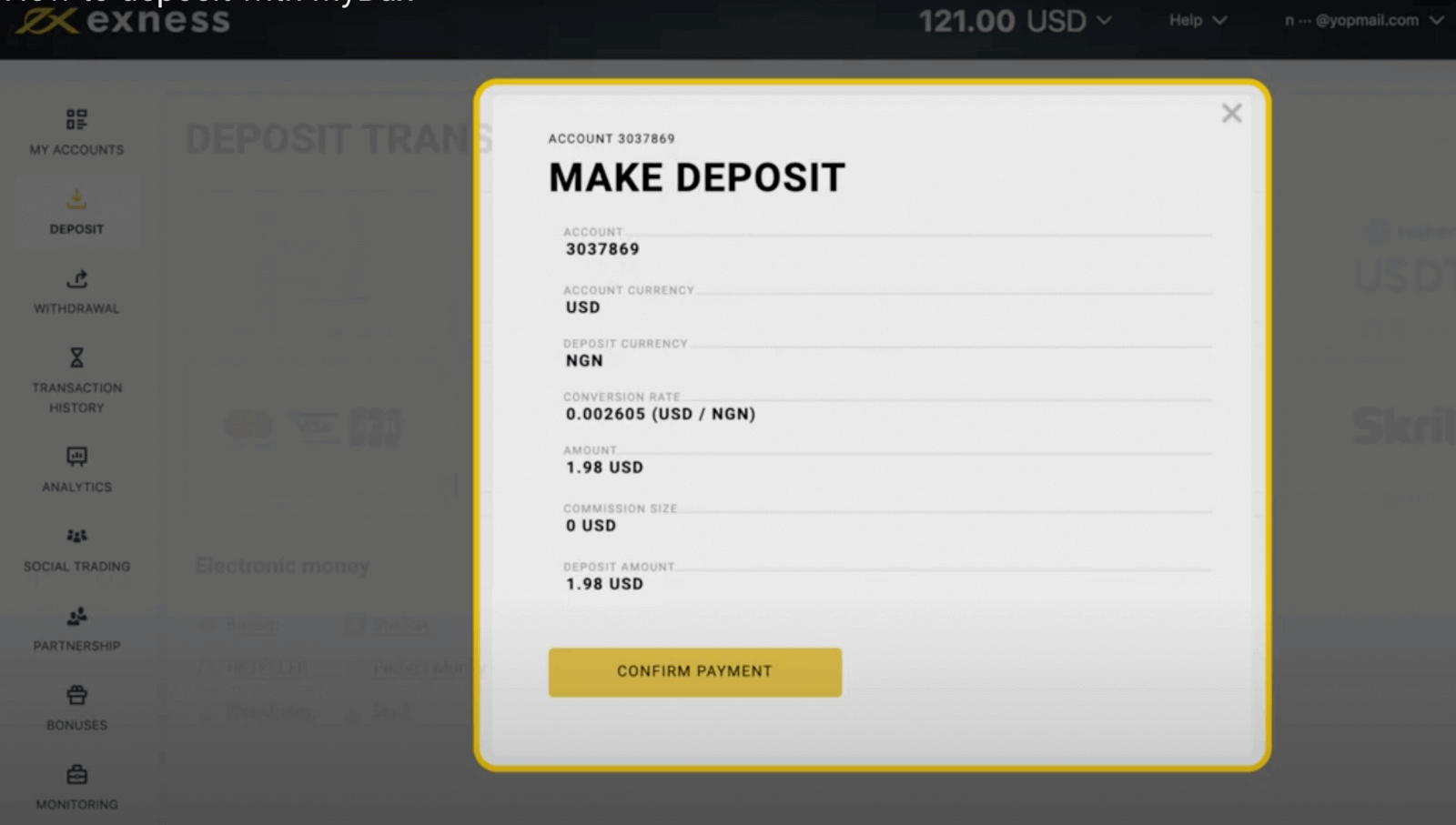

3. A summary of the transaction will be presented to you; simply click Confirm Payment if you are happy to continue.

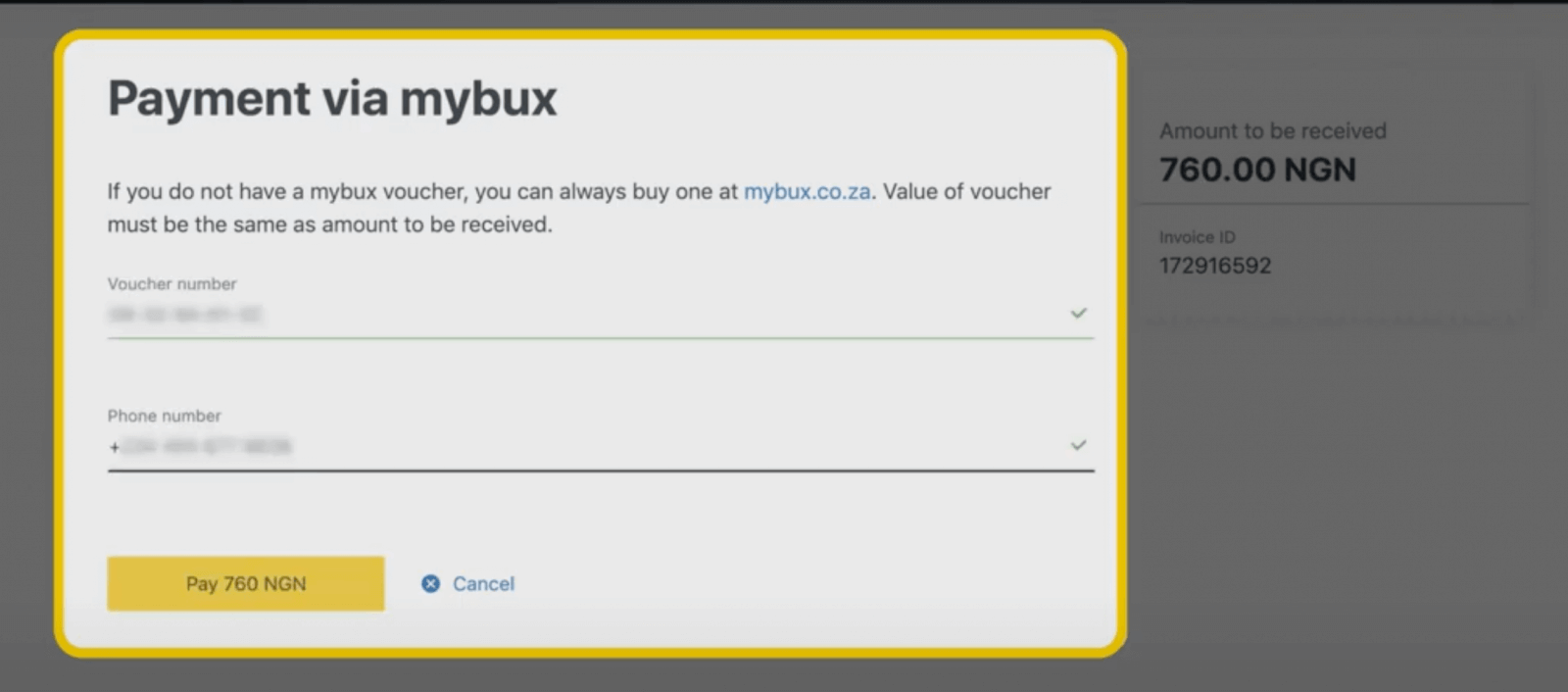

4. Provide the following information:

- MyBux Voucher number (sent to the email address entered when the voucher was purchased).

- Phone number (this must be the number linked to the voucher when purchased).

5. You will be redirected to a confirmation page, informing you of a successful deposit.

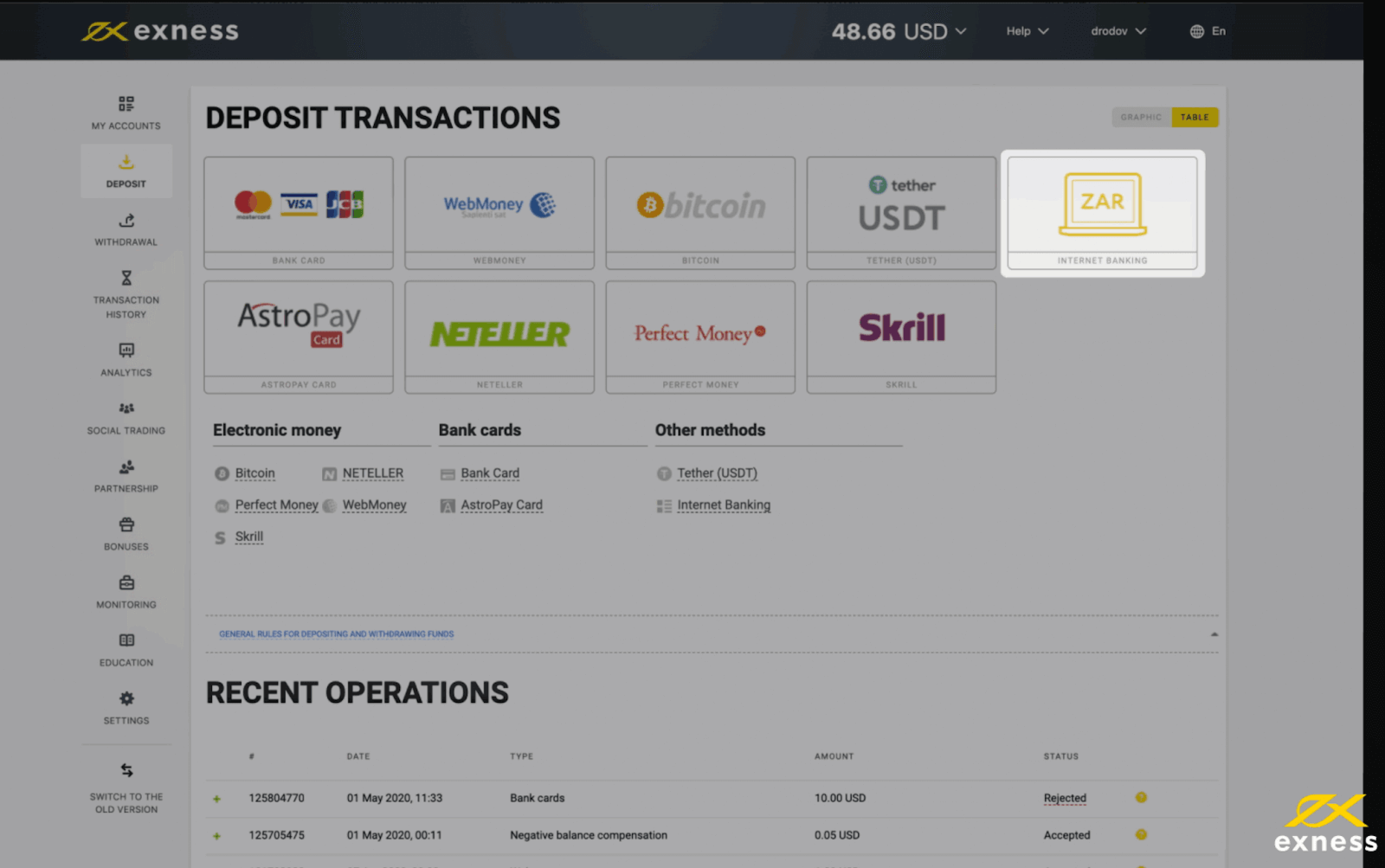

Deposit into Exness Africa via Internet banking

Top up your trading account in South African rands via Internet banking, a payment method that allows you to transfer funds online from your bank account to your Exness account.

As opposed to payments in USD or any other currency, depositing using your local currency means saving on currency conversion. Additionally, there is no commission when funding your Exness account via Internet banking in South Africa.

Here’s what you need to know about using internet banking in South Africa:

|

South Africa |

|

| Minimum Deposit | USD 10 USD |

| Maximum Deposit | USD 29 000 |

| Minimum Withdrawal | USD 4 |

| Maximum Withdrawal | USD 15 300 |

| Deposit and Withdrawal Processing Fees | Free |

| Deposit Processing Time | Instant* |

| Withdrawal Processing Time | Up to 72 hours or 3 working days |

*The term “instant” indicates that a transaction will be carried out within a few seconds without manual processing by our financial department specialists.

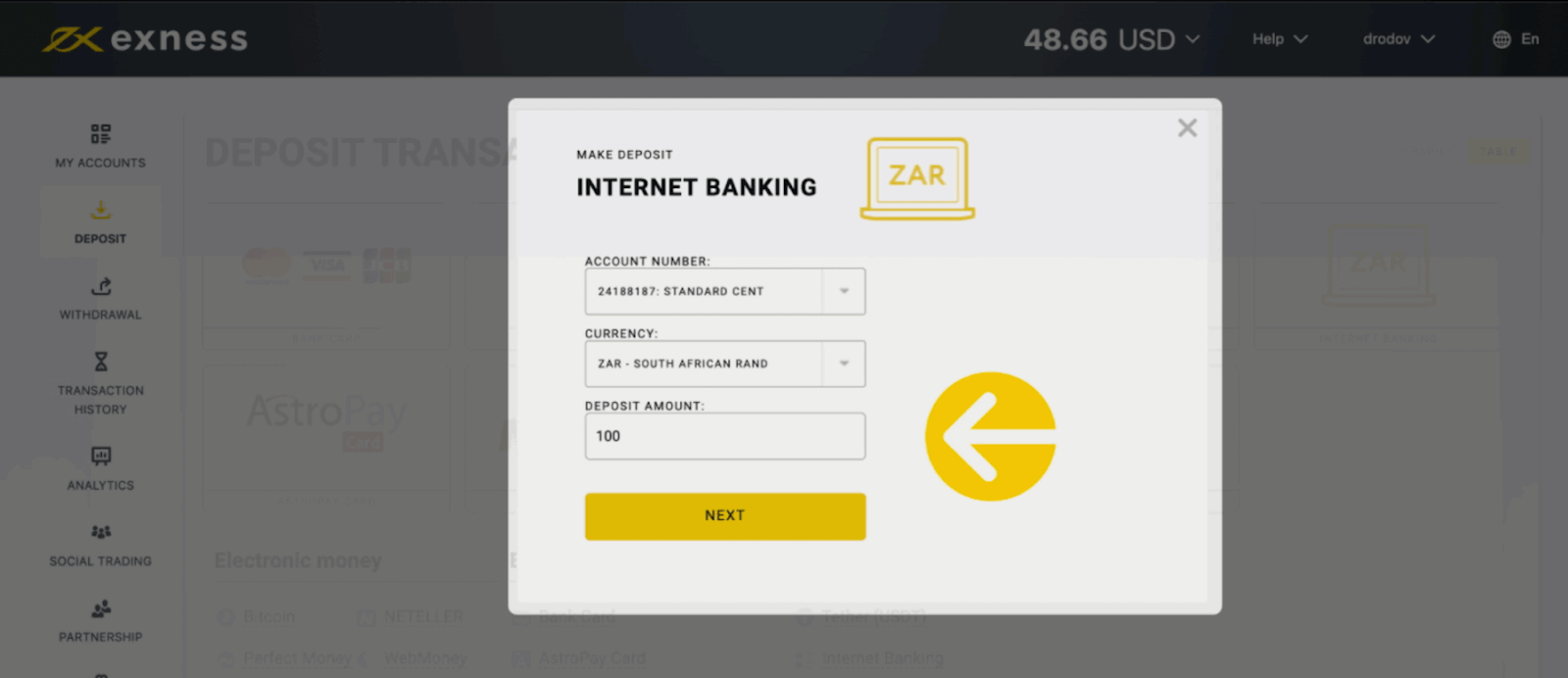

Note: The limits specified above are per transaction unless mentioned otherwise.1. Go to the Deposit section in your Personal Area, and click Internet banking.

2. Select the trading account you would like to top up, enter the deposit amount (in ZAR), and click Next.

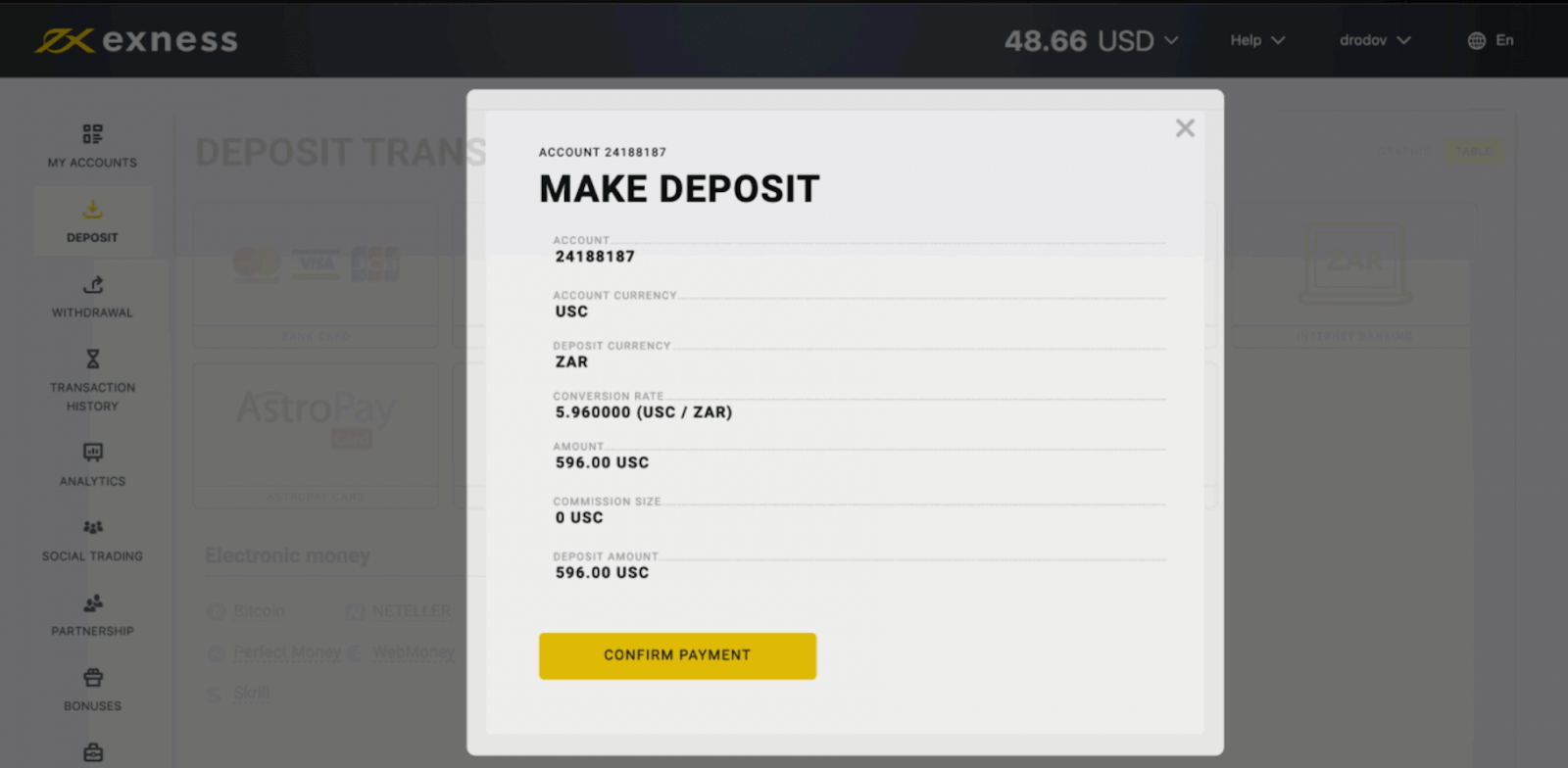

3. Check all details and click on Confirm Payment.

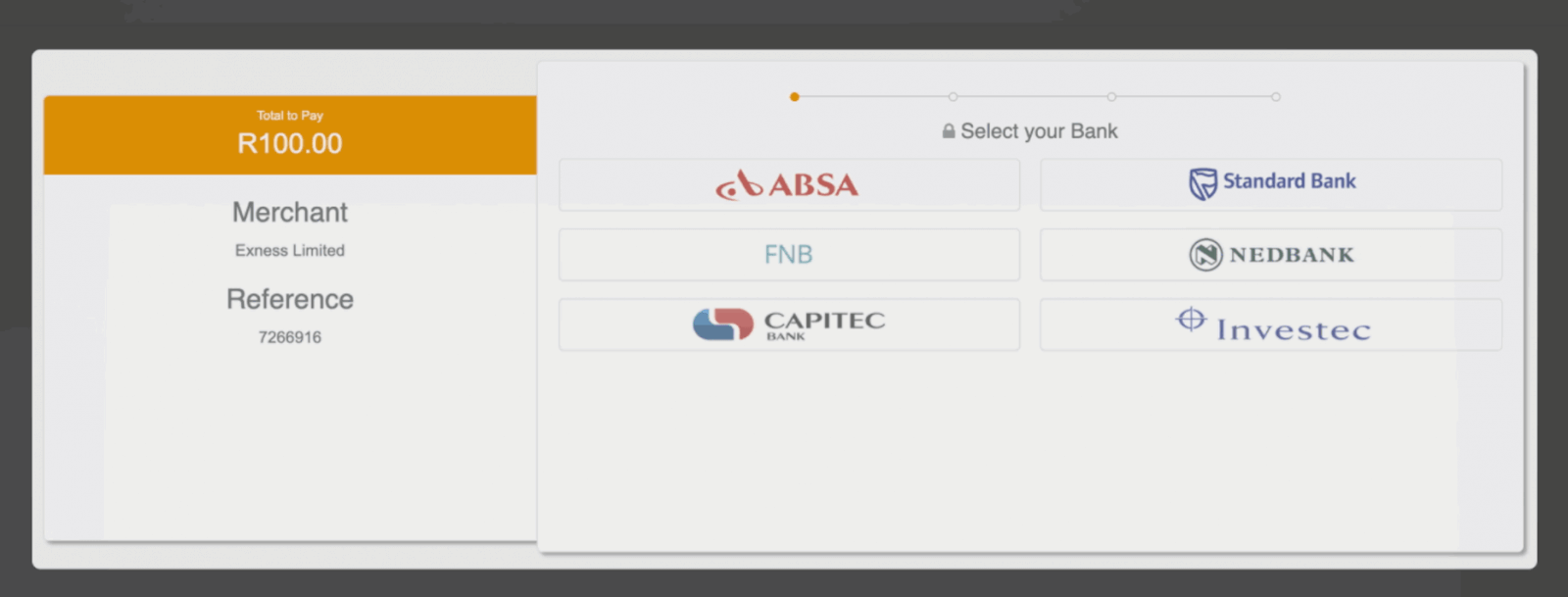

4. You’ll be redirected to the page where you’ll need to select your bank and follow the prompts to complete payment.

Here is a list of the details required by each bank:

| Name of the bank | Information required |

|---|---|

| ABSA | Access account number, PIN, and user number |

| Standard Bank | Email and password |

| First National Bank (FNB) | Username and password for internet banking |

| NEDBANK | Profile number, PIN, and password |

| Capitec Bank | Username and password/remote PIN |

| Investec | Investec ID and password |

Once you complete the payment, the funds will be credited to your Exness account instantly.

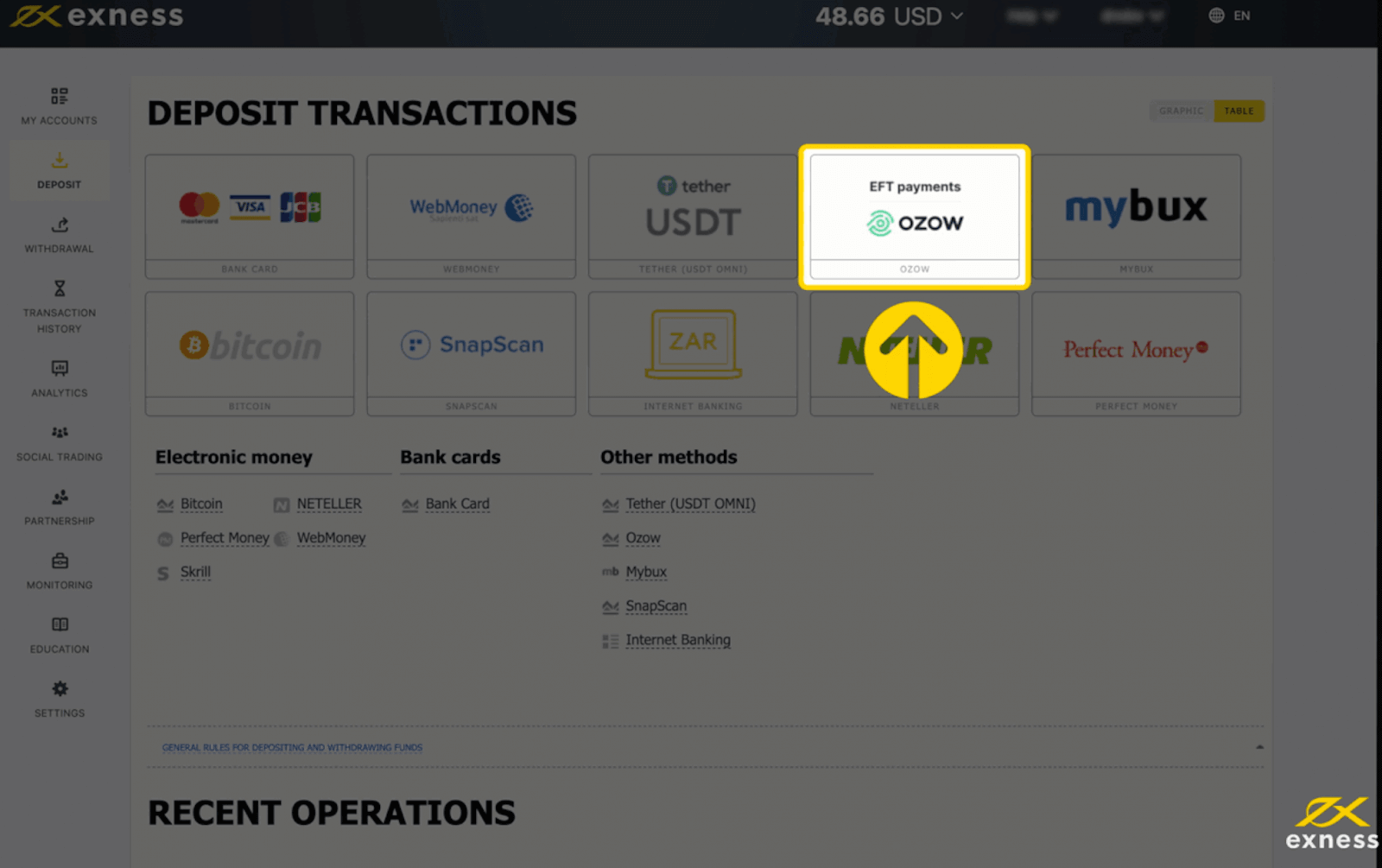

Deposit into Exness Africa via Ozow

It’s easier than ever to fund your Exness account with Ozow, available for online transactions that work with major banks in South Africa. There’s no commission when depositing into your Exness account with this payment option. Though withdrawals must be made using the MyBux payment system, these are offered free of charge too.Here’s what you need to know about using Ozow:

| South Africa | |

|---|---|

| Minimum Deposit | USD 10 |

| Maximum Deposit | USD 900 |

| Minimum Withdrawal (with MyBux) | USD 5 |

| Maximum Withdrawal (with MyBux) | USD 550 |

| Deposit Processing Fees | Free |

| Withdrawal Processing Fees | A fee may be applicable depending on your mobile operator |

| Deposit and Withdrawal Processing Time | Instant* |

*The term “instant” indicates that a transaction will be carried out within a few seconds without manual processing by our financial department specialists.

Note: The limits specified above are per transaction unless mentioned otherwise.

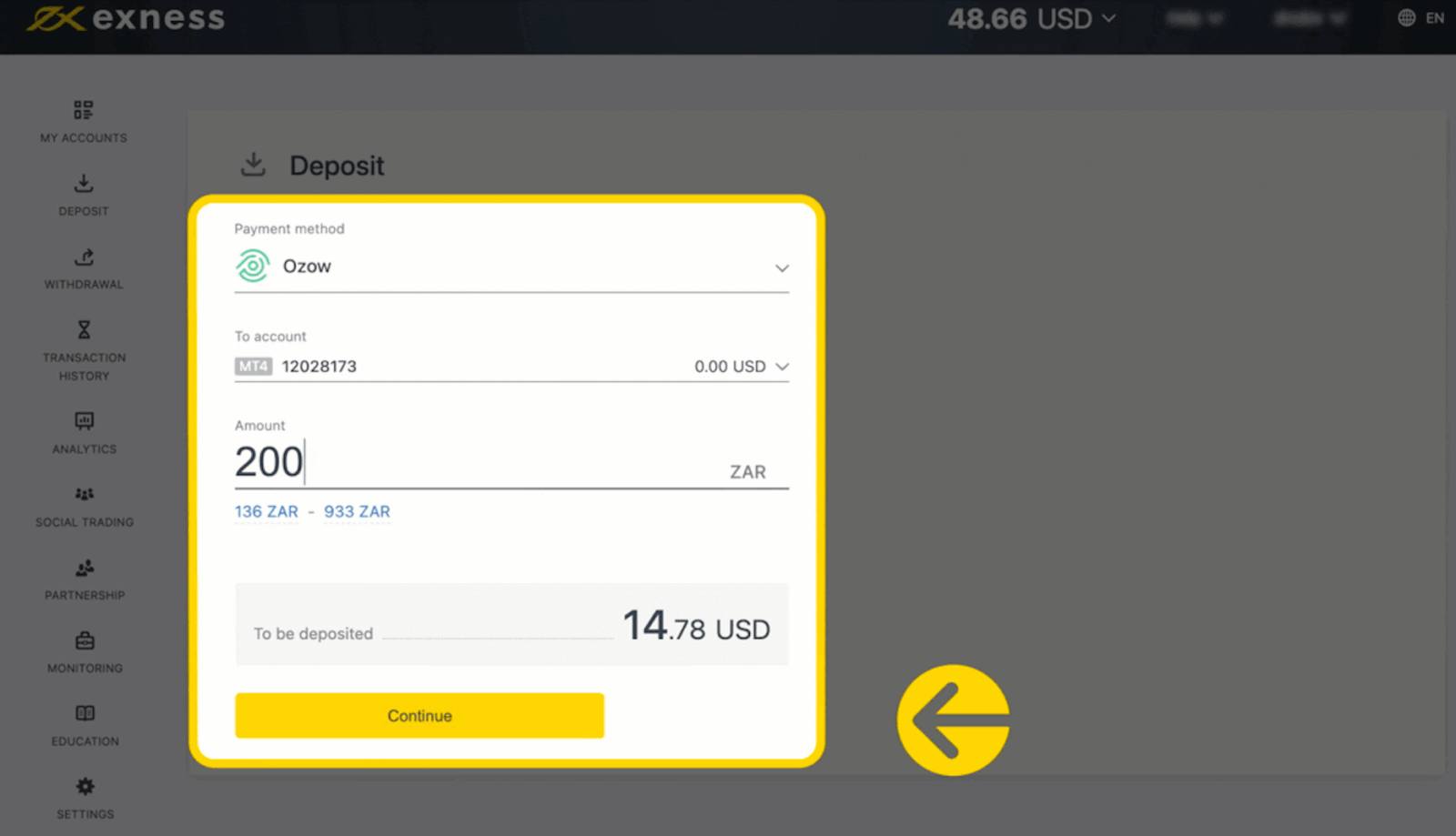

1. Go to the Deposit section in your Personal Area, and choose Ozow.

2. Select the trading account you would like to top up, as well as the deposit amount, then click Next.

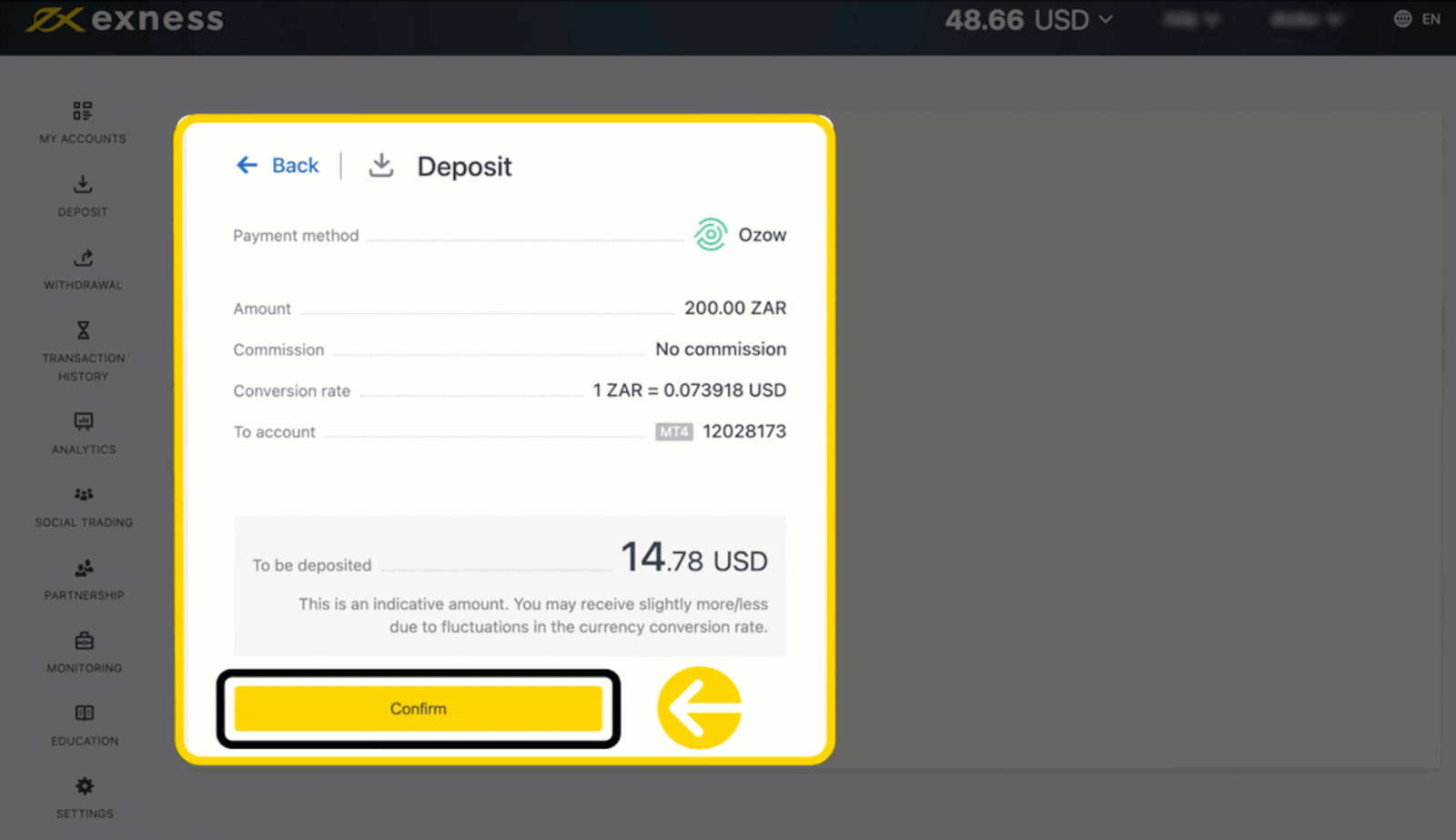

3. A summary of the transaction will be presented to you; simply click Confirm if you are happy to continue.

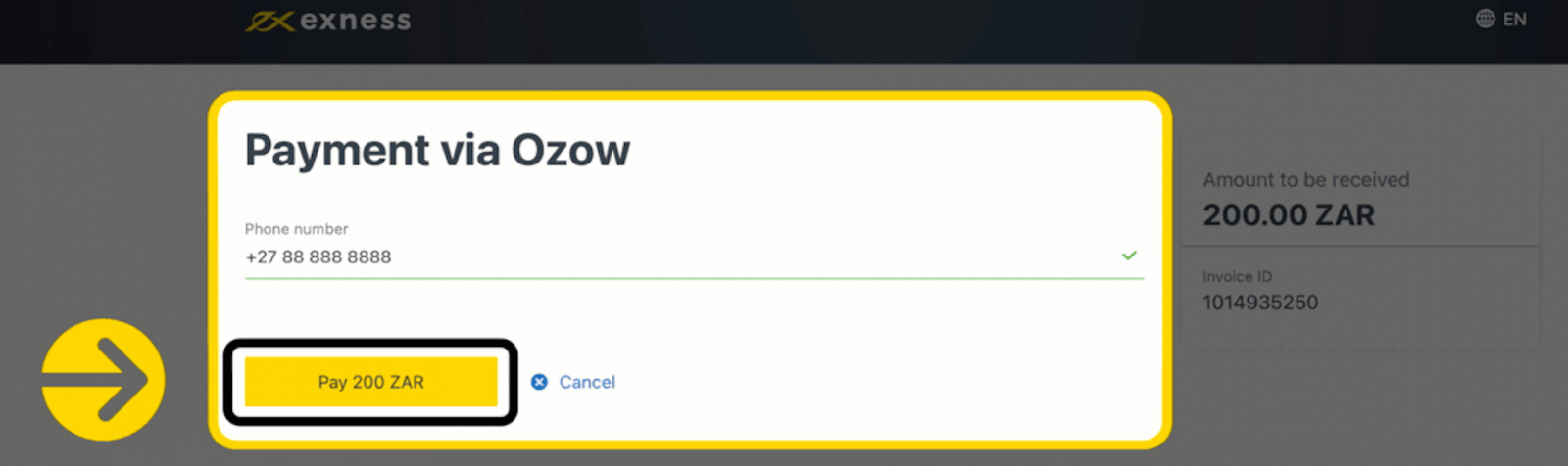

4. Now confirm your registered phone number (this must be the same one registered with Ozow), then click Pay to continue.

5. You will be redirected to a page where you are prompted to select your bank.

6. After logging into your online account, continue to follow the prompts to complete your transaction.

How to Withdraw Money from Exness Africa

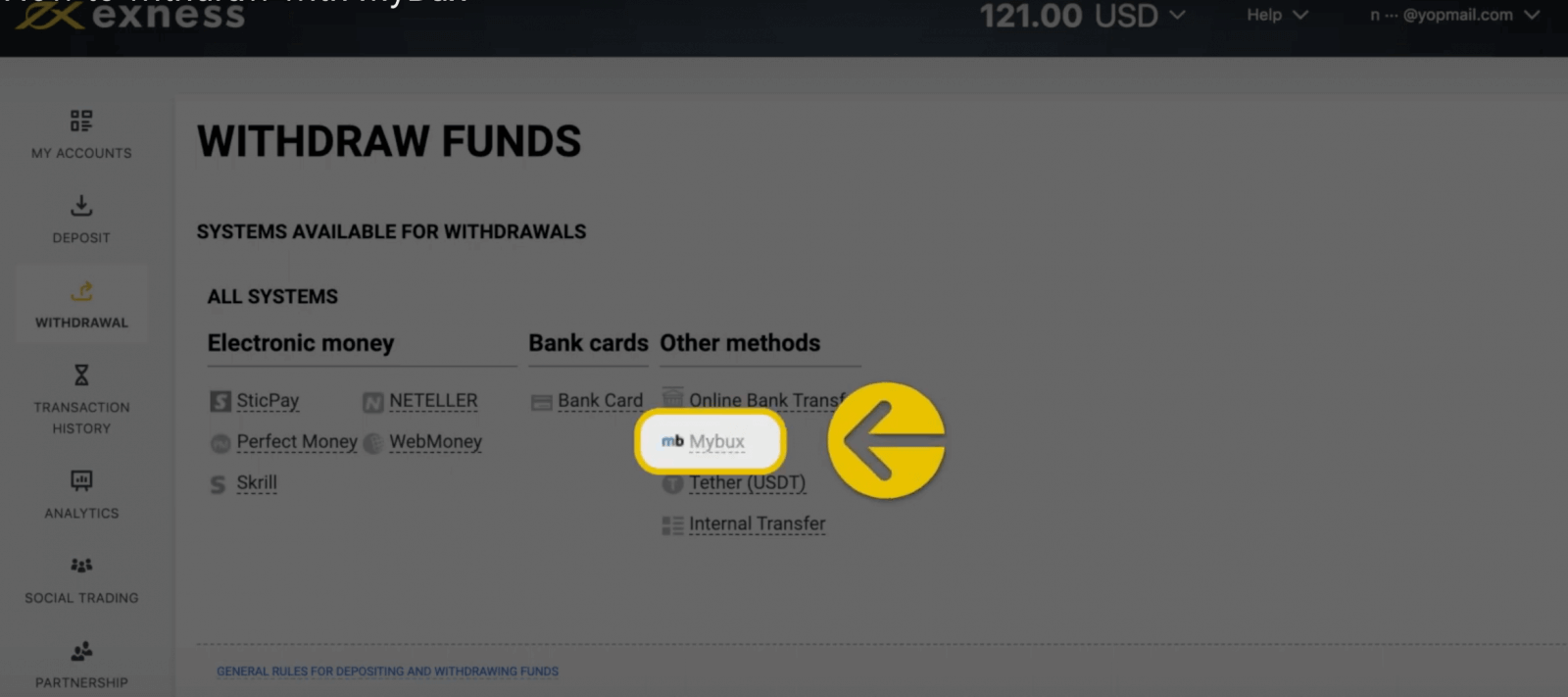

Withdraw from Exness Africa via MyBux

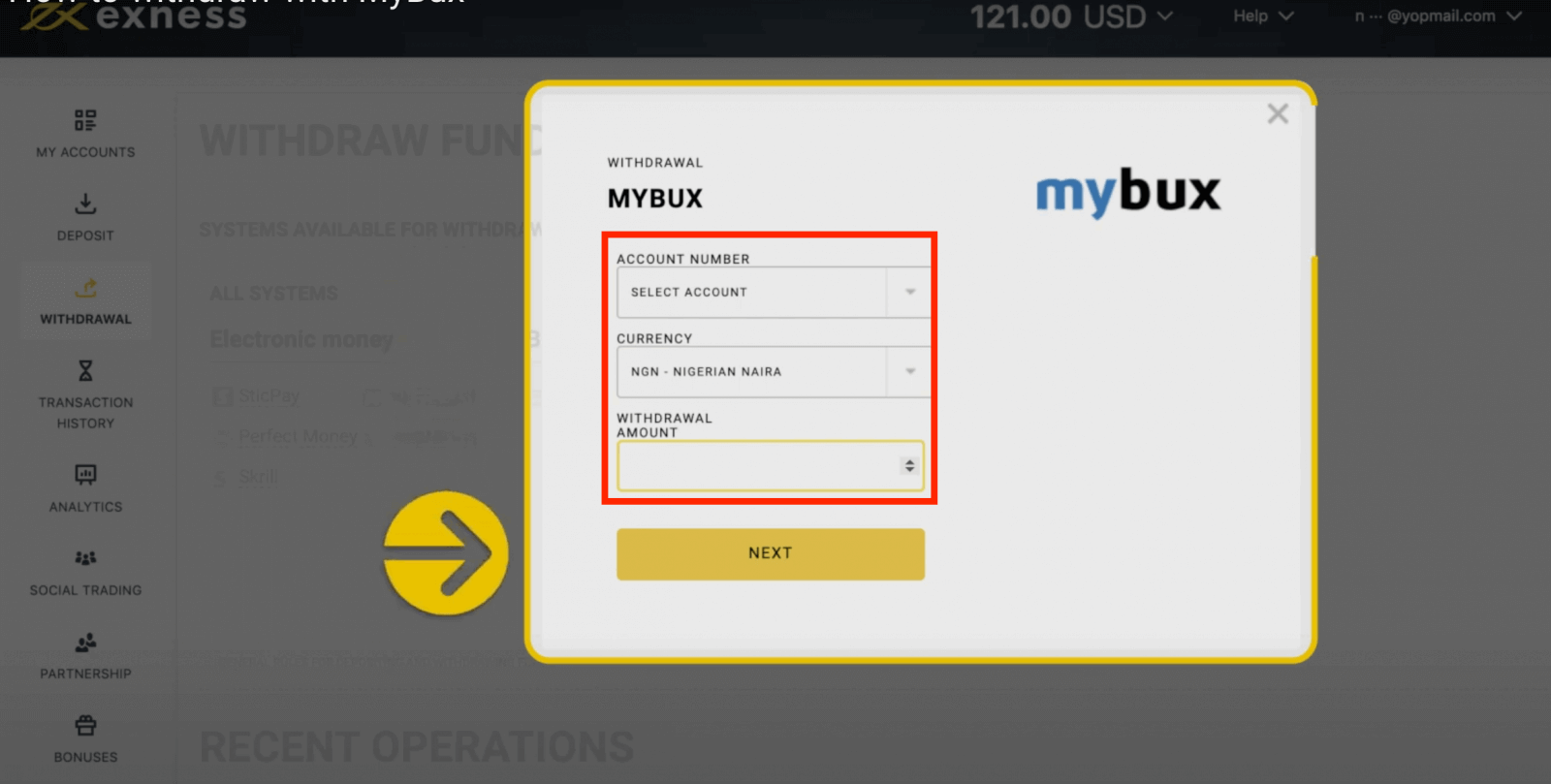

1. Click MyBux in the Withdrawal section of your Personal Area.

2. Select the trading account you would like to withdraw funds from, the chosen currency of withdrawal, and the withdrawal amount. Click Next.

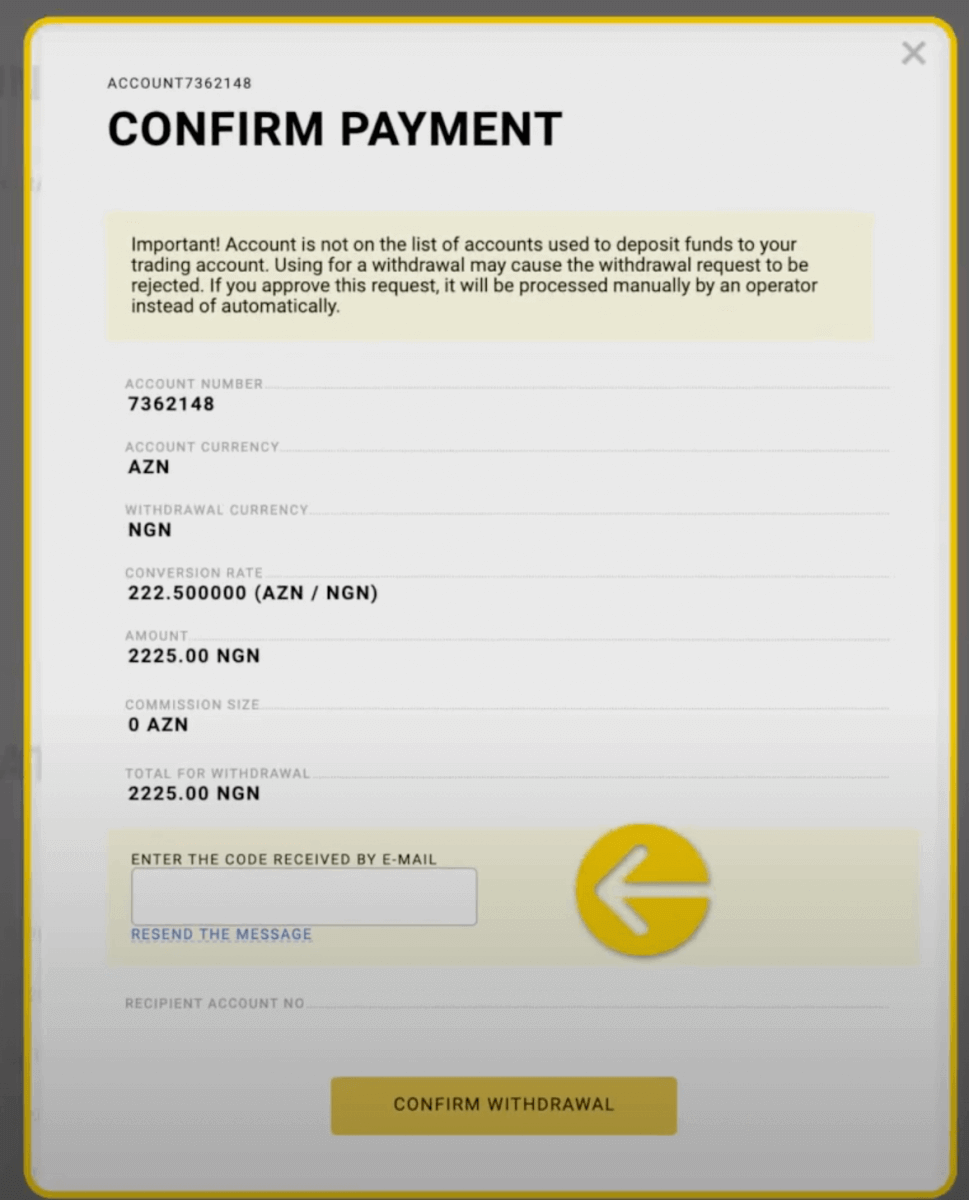

3. A summary of the transaction will be shown. Enter the verification code sent to you either by email or SMS depending on your Personal Area security type. Click Confirm withdrawal.

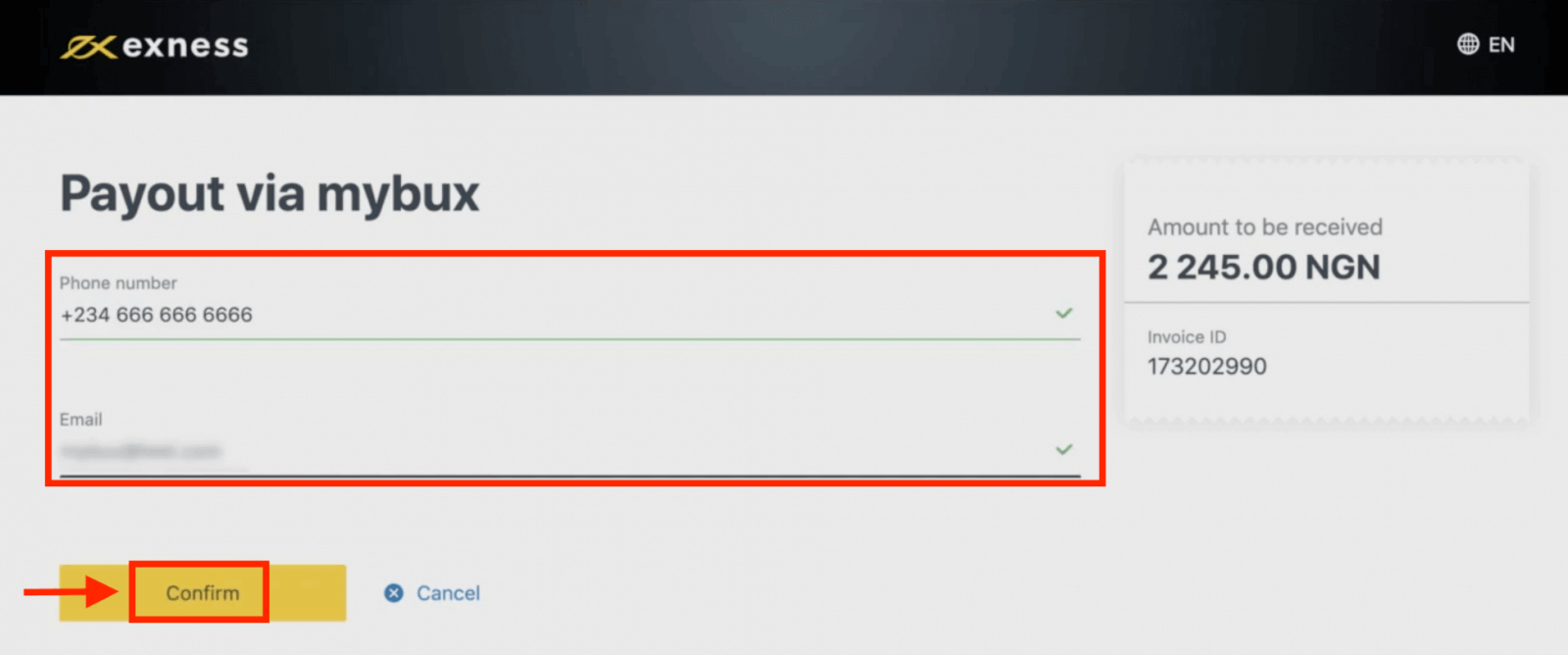

4. On the next screen, please provide:

- Email address (details about your MyBux voucher to the value of the withdrawal amount will be sent here).

- Phone number (this is the phone number that will be linked to the MyBux voucher for withdrawal).

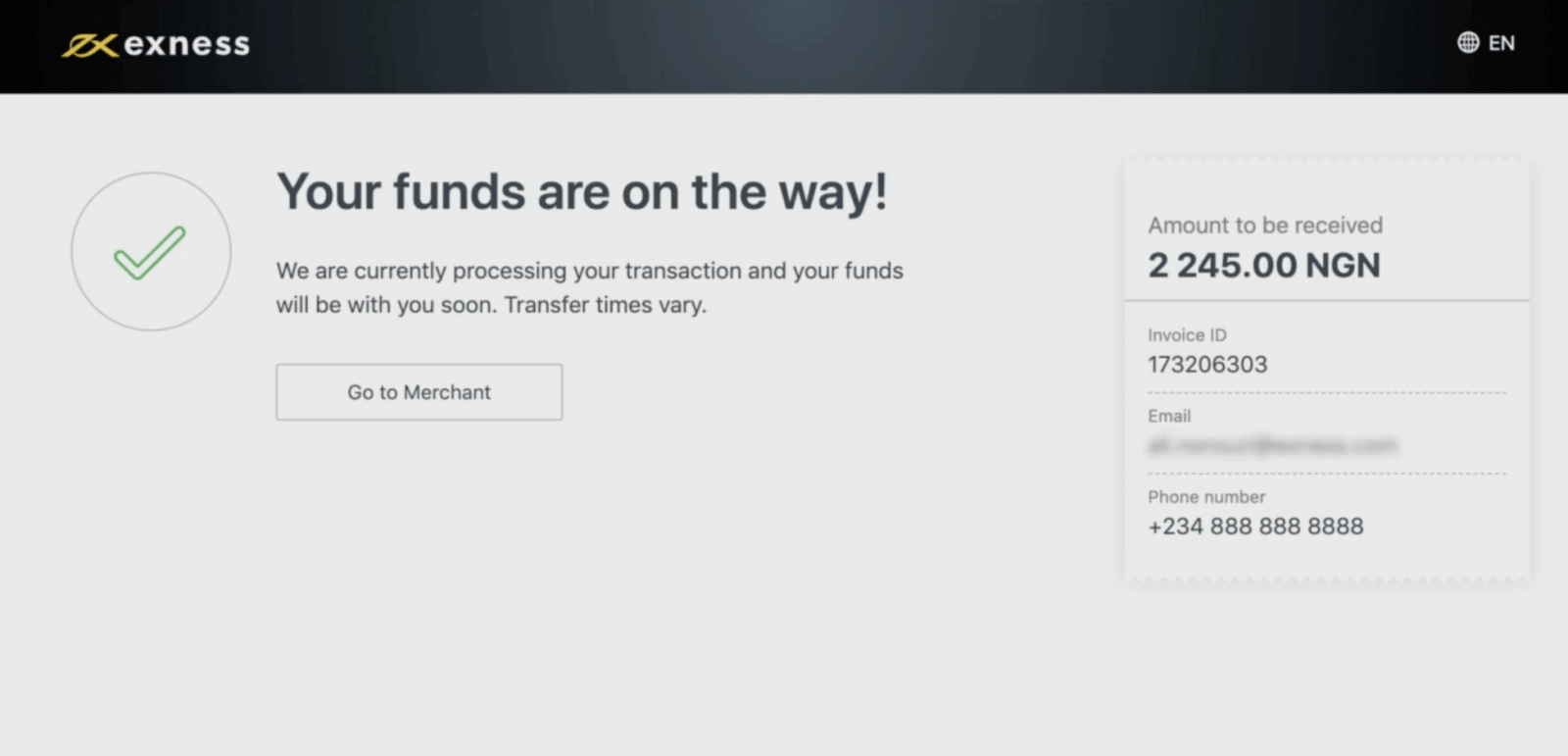

5. A confirmation page will be presented to you, with the withdrawal process complete. You can now redeem your MyBux voucher on MyBux.co.za under ‘Cash Out mybux’, following the instructions presented on the site.

Withdraw from Exness Africa via Internet banking

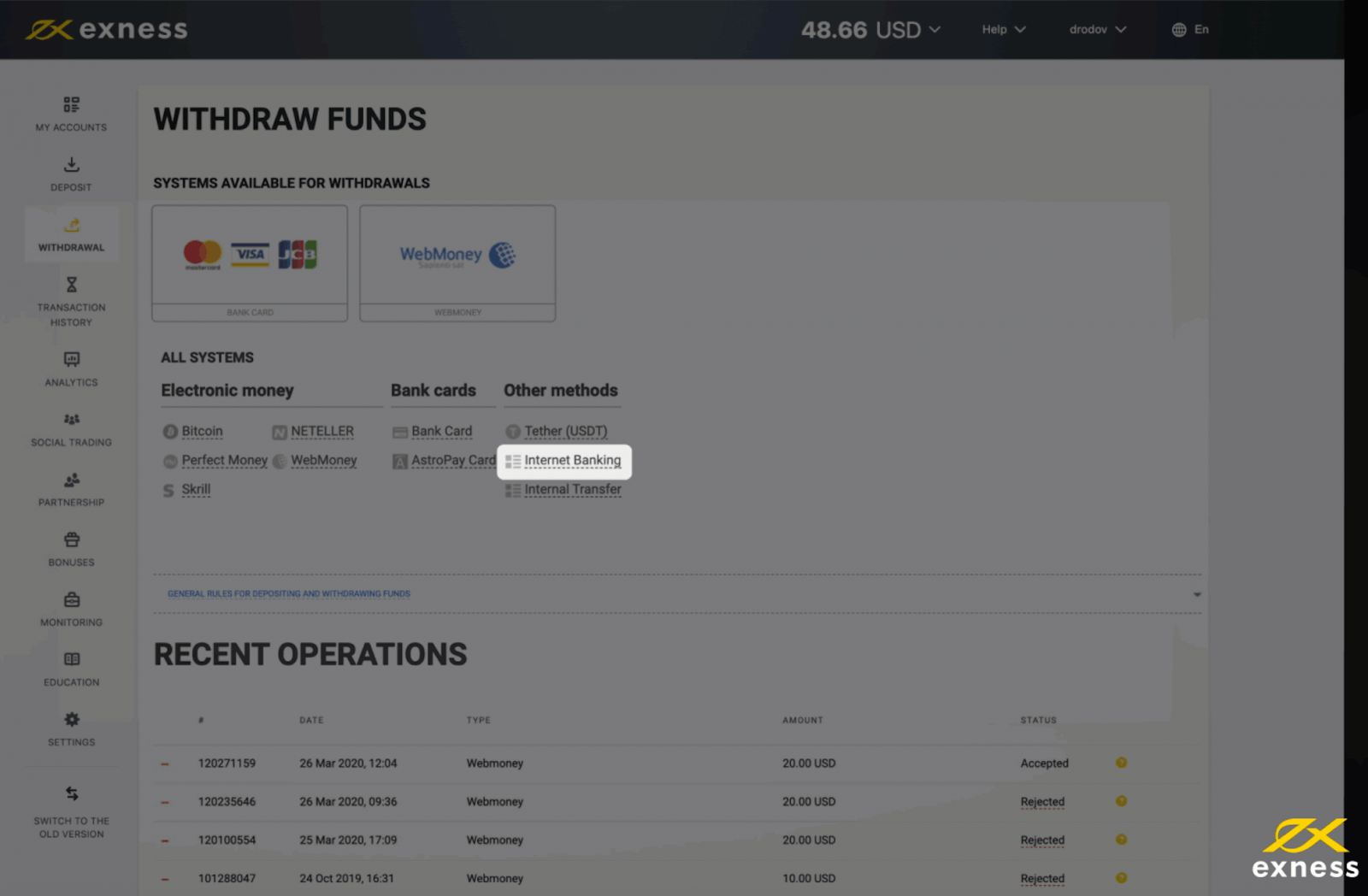

1. Click Internet Banking in the Withdrawal section of your Personal Area.

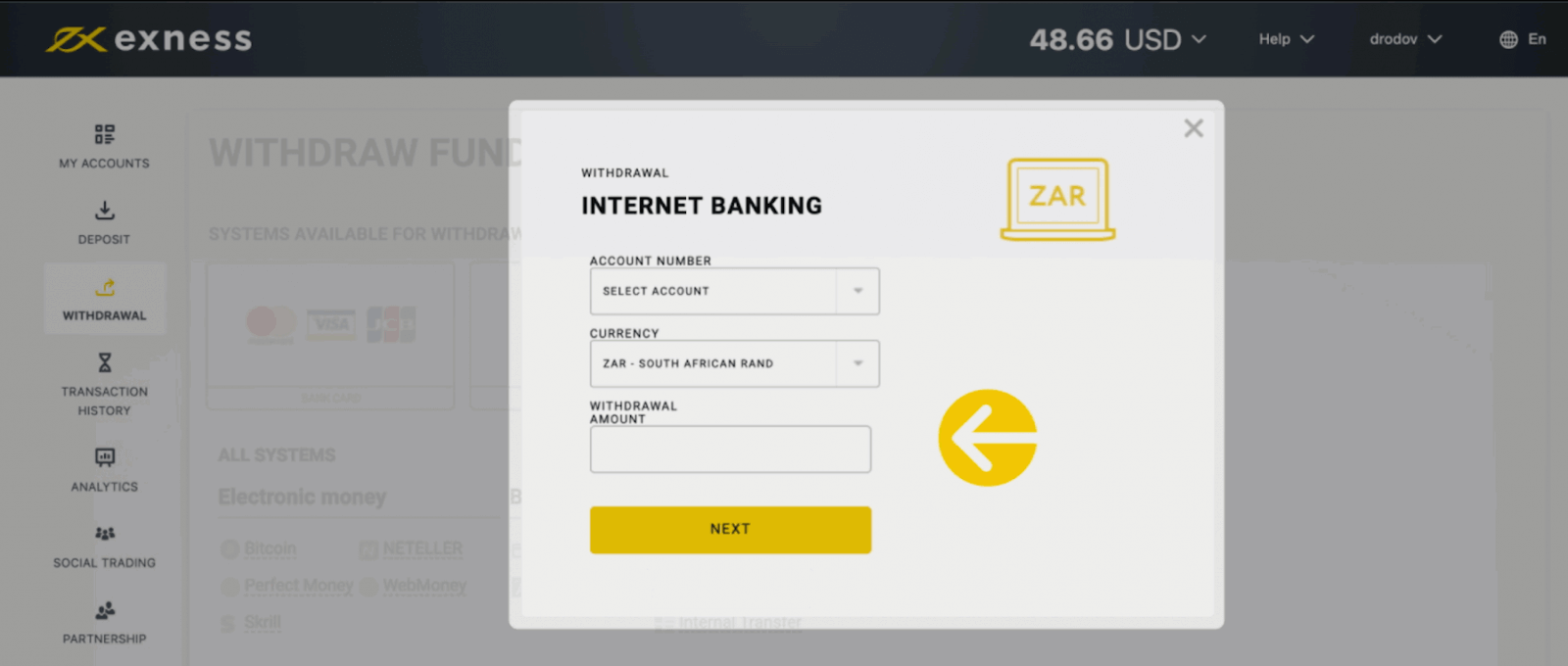

2. Select the trading account you would like to withdraw funds from, choose the withdrawal currency, and specify the withdrawal amount in your account currency. Click Next.

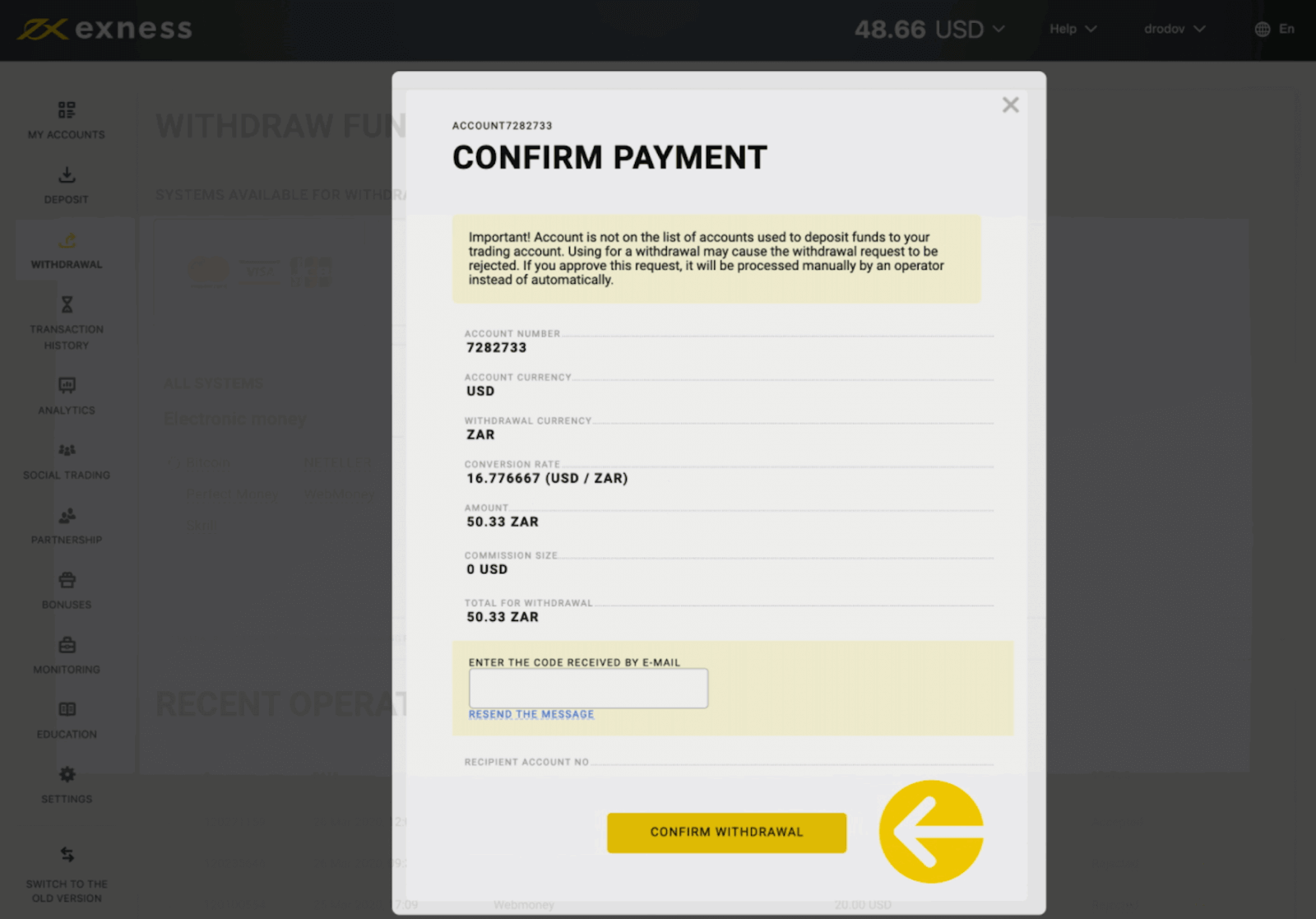

3. A summary of the transaction will be shown. Enter the verification code sent to you either by email or SMS depending on your Personal Area security type. Click Confirm withdrawal.

4. You will be redirected to the payment gateway page where you will need to input your bank account number, your name and choose a bank from the dropdown. Click Submit.

The funds will be credited to your bank account within 3 working days.